Diversified Energy's Strategic Joint Acquisition of East Texas Assets

Overview of the Joint Acquisition

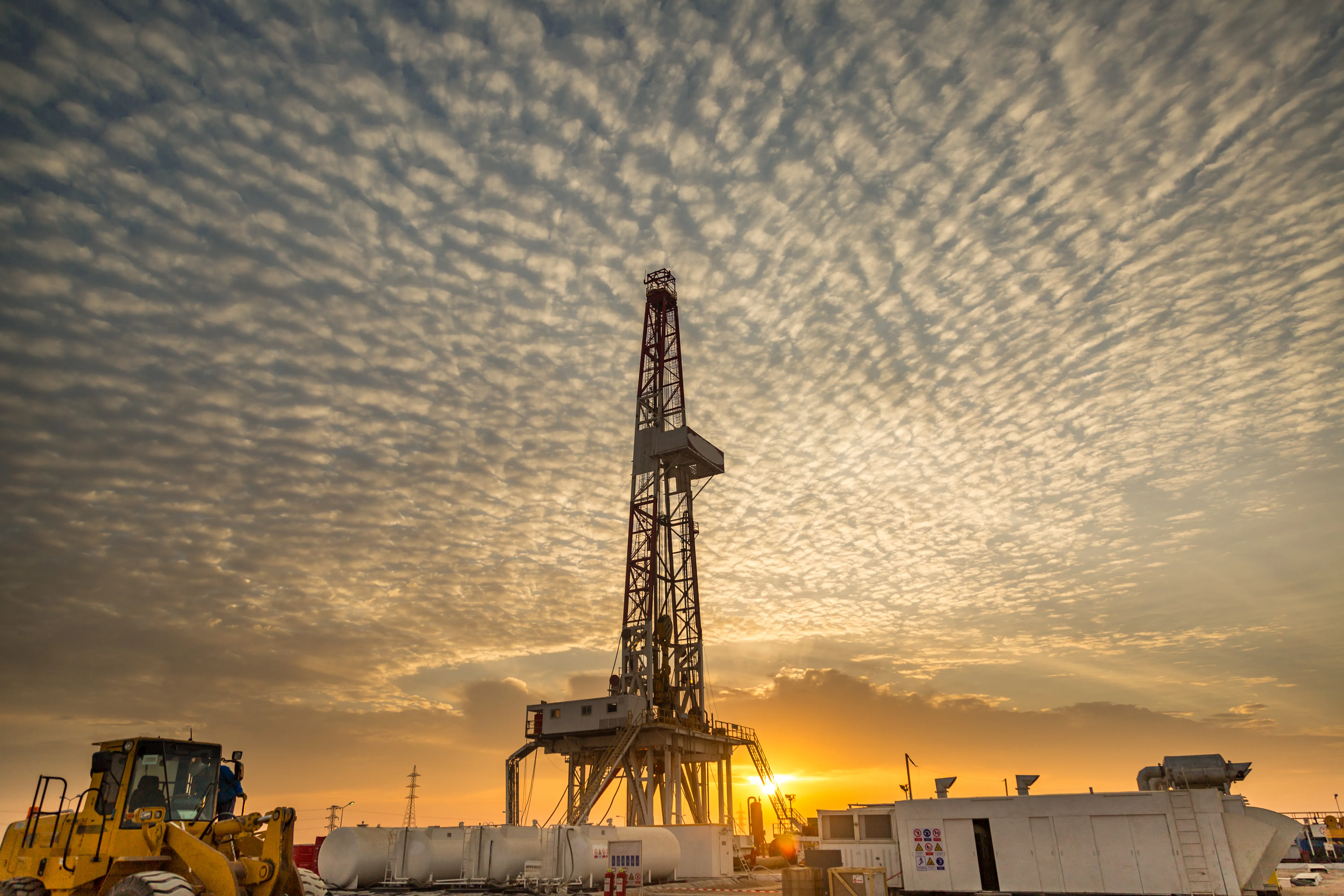

Diversified Energy (DEC) has made headlines by announcing a joint acquisition of operated natural gas properties located in eastern Texas for an investment totaling $68 million. The transaction aims to amplify the company's production levels and expand its reserves significantly.

Implications for Market Performance

This acquisition is poised to have substantial implications for DEC's overall performance in the financial markets. With this move, Diversified Energy signals its commitment to growth and expansion, which could attract further investor interest.

- Strategic growth: Enhancing asset base

- Market reactions: Anticipated investor response

- Long-term benefits: Reserves and production increase

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.