Analyzing the VanEck Uranium and Nuclear ETF (NYSEARCA:NLR)

Overview of NLR

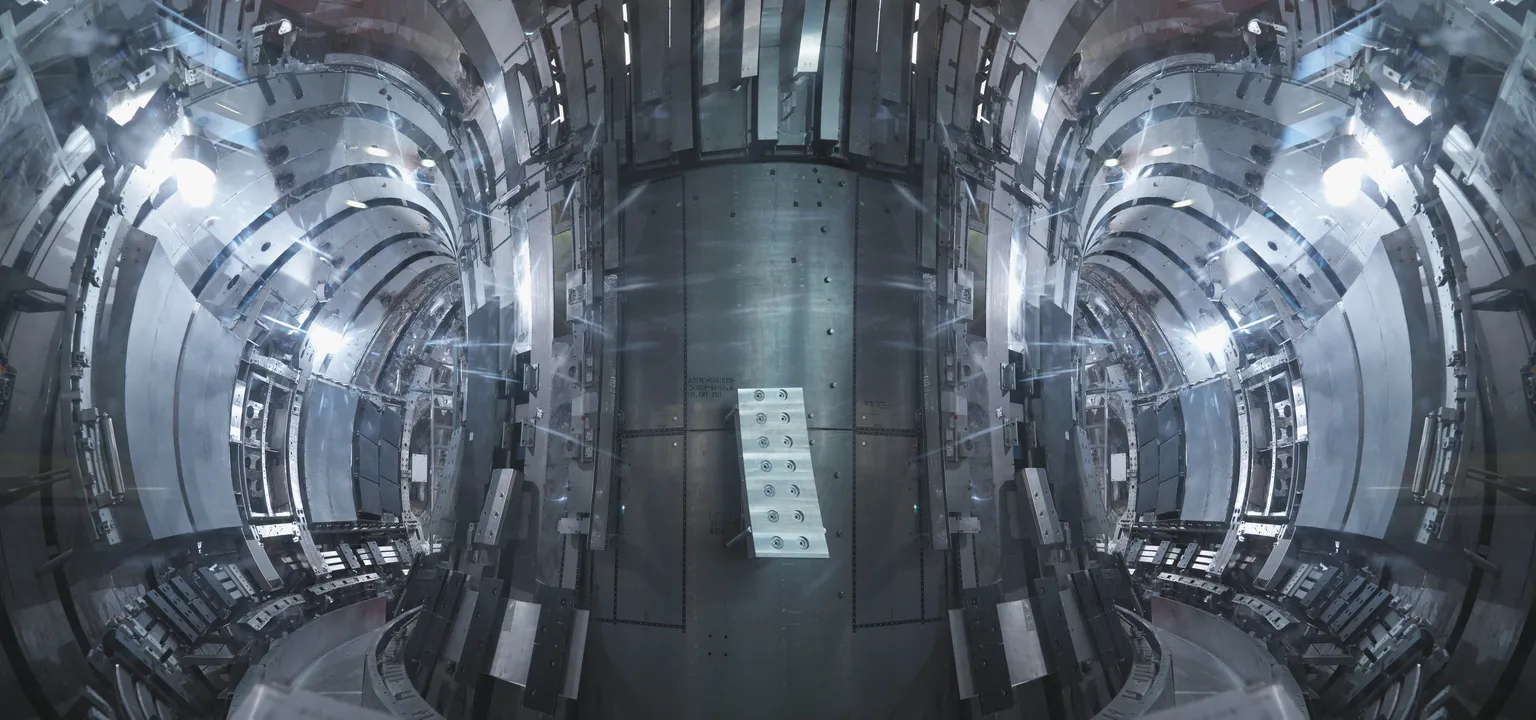

The VanEck Uranium and Nuclear ETF (NLR) is designed to provide investors with access to the nuclear power sector, capitalizing on the increasing demand for clean energy sources.

Key Features

- Exposure to Nuclear Energy: NLR focuses on companies involved in uranium mining and nuclear power generation.

- Utility Offering: It serves as a utility option for investors looking to diversify their energy portfolios.

Investment Potential

Given the global shift towards sustainable energy solutions, investing in NLR may present valuable opportunities for growth in the nuclear sector.

Conclusion

For those looking to invest in the energy market, NLR offers a compelling opportunity to gain exposure to the uranium sector while benefiting from the stability of traditional power generation.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.