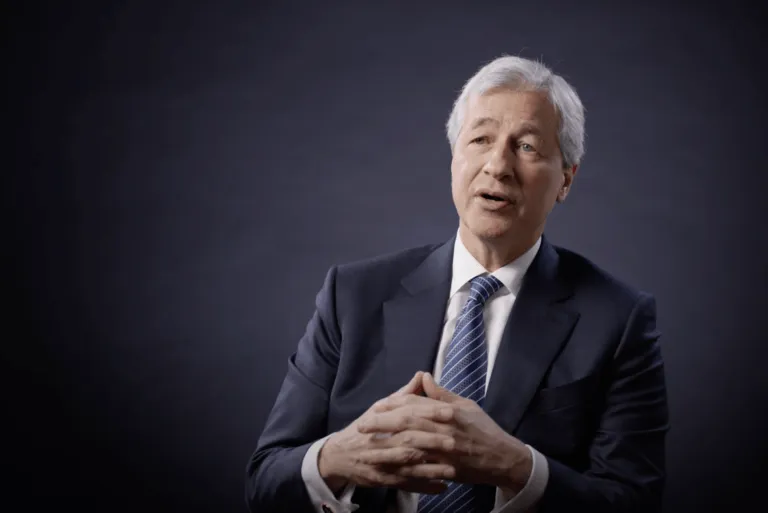

JPM Stock: Understanding Jamie Dimon's Warnings on Economic Risks

JPM Stock and Dimon's Warning

JPM stock remains a focal point for investors as Jamie Dimon, the CEO of JPMorgan Chase, raises alarms about potential economic downturns.

Risks Beyond Recession

Dimon's comments highlight a reality that is challenging: the US economy faces risks that could be more daunting than a traditional recession. Here’s a breakdown of the key points:

- Increased inflationary pressures could impact corporate earnings.

- Geopolitical tensions might lead to financial instability.

- Market volatility is anticipated, affecting JPM stock and others.

Market Implications

As investors, it’s vital to comprehend how these concerns affect JPM stock and the broader market. Reviewing investment strategies may be necessary in light of such warnings. For more insights on the US economy and stock market forecasts, visit trustworthy sources.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.