Skattesänkning 2025: What the Government Is Proposing

Skattesänkning 2025: A Bold Proposal from the Government

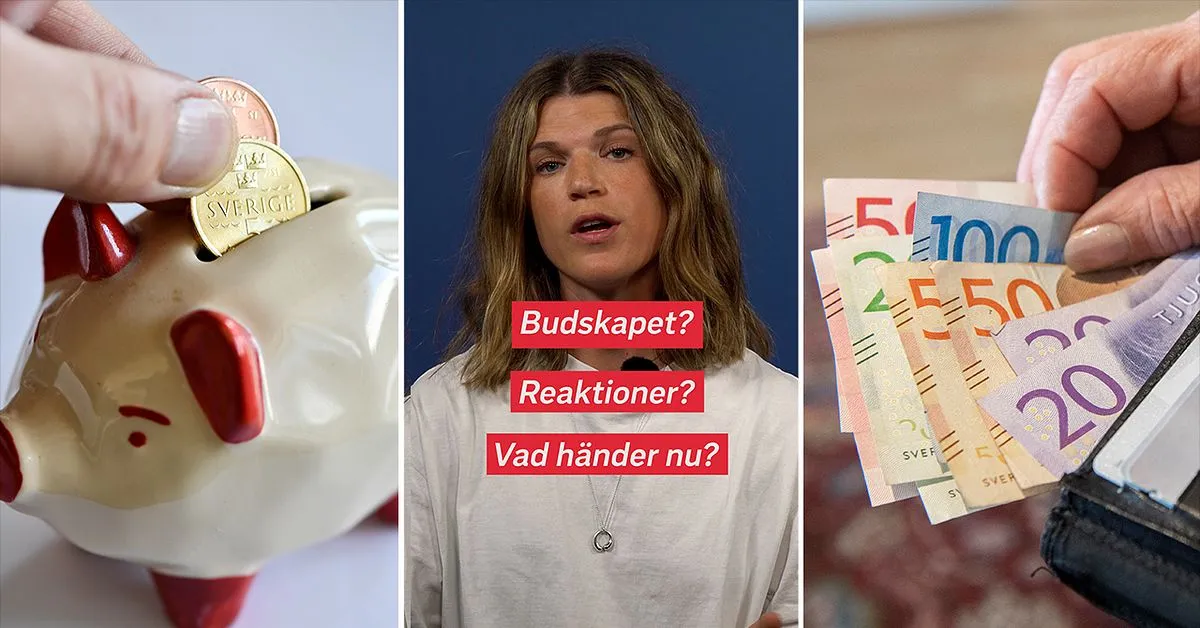

As we approach the end of the year, skattesänkning 2025 becomes a crucial topic in the political arena. The government has announced plans to initiate tax cuts that could significantly impact both individuals and businesses.

Key Details of the Tax Cuts

- Enhanced financial relief for households.

- Boost to economic growth through increased spending potential.

- Focus on easing tax burdens for small businesses.

Implications of Skattesänkning 2025

- Increased disposable income for citizens.

- Potential challenges in budget allocations for public services.

- Long-term economic stimulation expected.

As discussions continue, stakeholders from various sectors will need to assess how skattesänkning 2025 might reshape the fiscal landscape. For more insights, stay informed with the latest news.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.