@History of Nvidia: Key Factors Behind the Stock Market Decline

Nvidia's Role in Stock Market Fluctuations

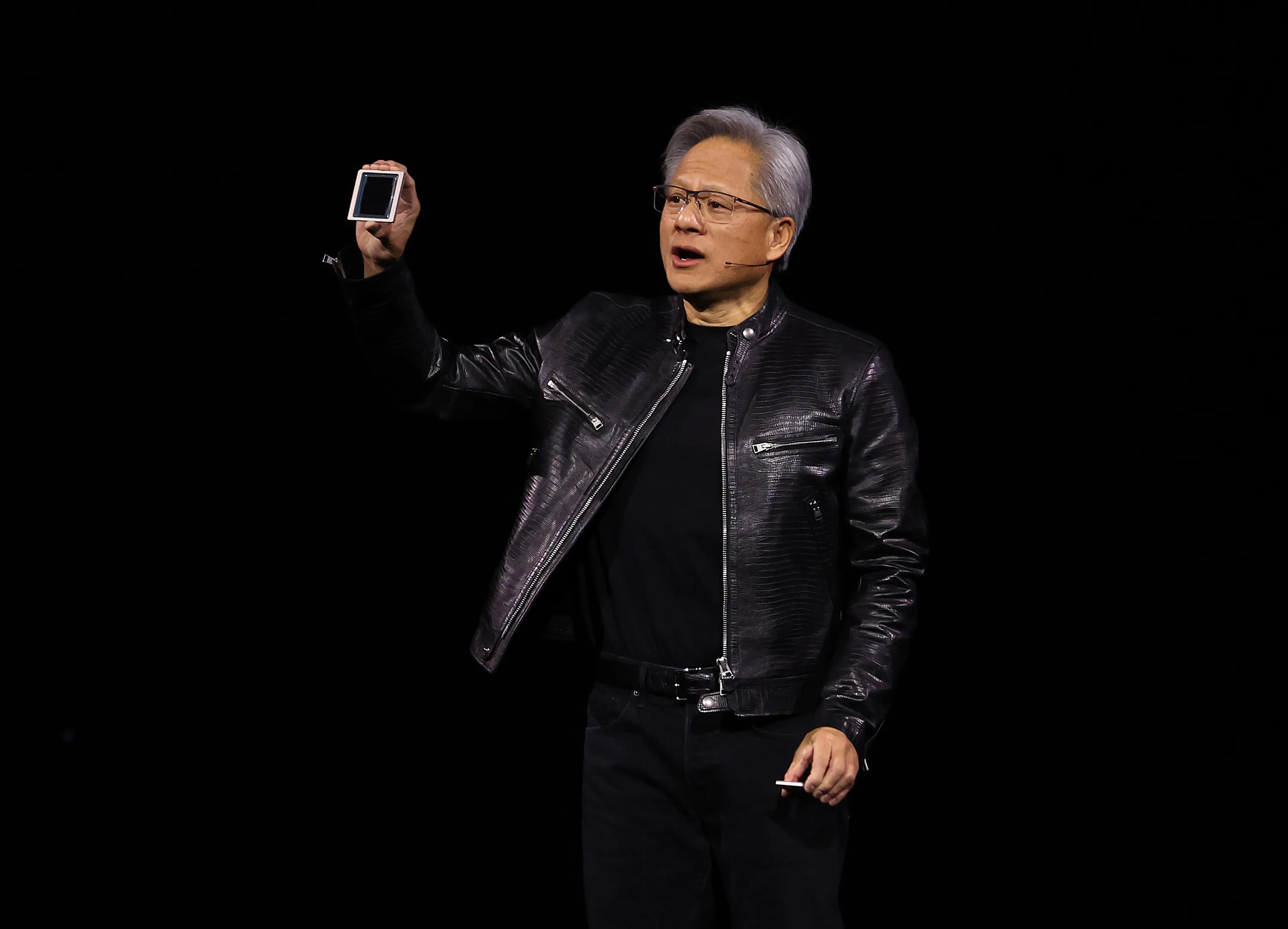

Nvidia, the world's leading AI chip manufacturer, sparked a global stock market downturn Wednesday, with indexes falling in Asia, Europe, and the United States. Following news that the US Justice Department issued Nvidia a subpoena as part of an antitrust investigation, investors sold $279 billion worth of shares — amounting to 9.5 percent of the company’s stock. This sell-off renews existing concerns about the strength of the AI sector and the US economy.

The Market's Reaction

Because of Nvidia's dominance, its success — or failure — can shift the tech-heavy Nasdaq stock index. Recent declines pushed sell-offs throughout the entire tech industry, impacting major players like Microsoft, Amazon, and Intel.

Wider Economic Concerns

- Concerns about China's sluggish economy

- Weak US manufacturing

- Worries about possible recession

While Nvidia triggered this week's stock slump, other factors like China's economy and AI investment strategies have investors rattled. Questions loom over whether Nvidia is overvalued and if such heavy investment in AI is warranted.

The Path Forward

Despite the sell-off, experts suggest that lowering interest rates could ease recession fears; however, uncertainty remains regarding the tech sector's future.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.