AI Stock: Nvidia's Unprecedented Market Freefall

AI Stock's Historic Decline

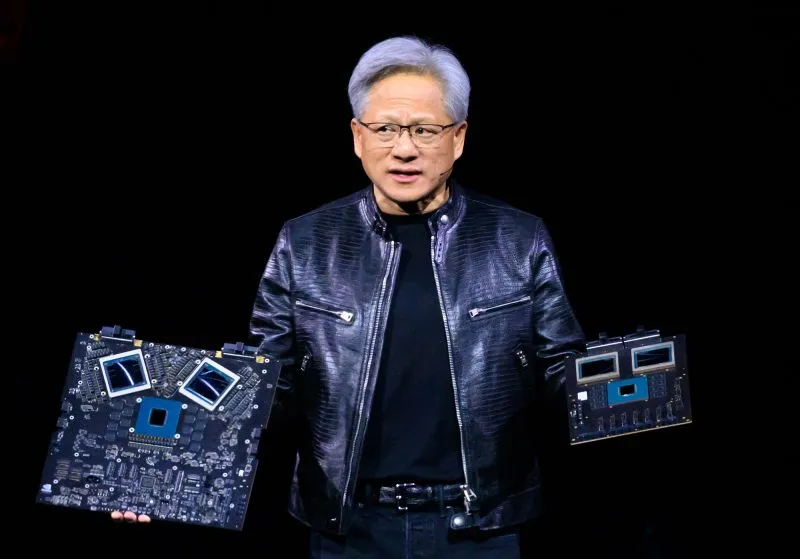

Nvidia, the AI chipmaking titan once worth over $3.3 trillion, has faced an astonishing decline in its stock value. On Tuesday, the company suffered its worst day ever, with a staggering $279 billion loss, greatly exceeding the previous record set by Meta in 2022.

Market Reactions and Economic Concerns

Investors are becoming increasingly skeptical about AI stocks following signs of economic stress in the US. Despite Nvidia's blockbuster earnings, tempered forecasts have contributed to a more cautious market outlook.

- Microsoft shares dropped by 12% in recent weeks.

- TSMC, a major competitor, has seen an 18% decline since July.

- Intel has undergone a staggering 59% decrease in its stock price this year.

Potential Legal Troubles Ahead

Adding fuel to the fire, reports suggest that Nvidia is being investigated for possible antitrust violations. The US Justice Department's inquiry has cast a shadow over the company's future, although Nvidia denies receiving a subpoena.

Investors Remain Hopeful

Despite this turmoil, many investors still believe in Nvidia’s long-term potential. With demand for its latest AI chips reportedly outstripping supply, there may be opportunities amid the chaos for those looking to invest.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.