Haftpflichtversicherung Costs Soar as Offenbach Tops Collision Reports

Haftpflichtversicherung Rates on the Rise

Insurance rates are experiencing a significant upward trend, particularly in regions like Offenbach, where collision incidents have surged. Consumers are grappling with the financial implications of these rising costs.

Collisions and Insurance Impact

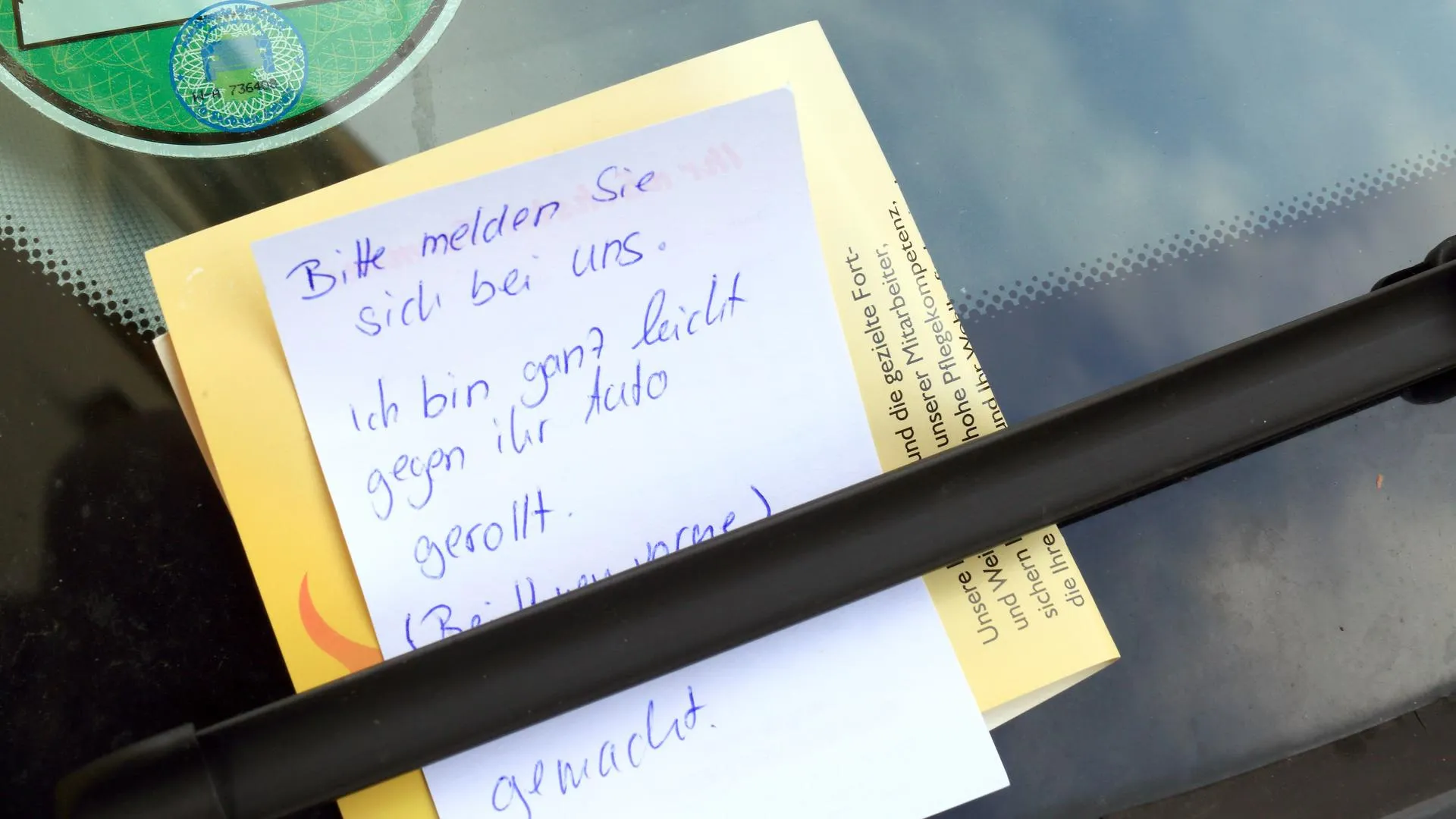

A recent report highlighted the increasing number of accidents in locations such as Bad Hersfeld and Wiesbaden. This rise in collisions has directly contributed to the soaring prices of haftpflichtversicherung.

- Frankfurt: A city with escalating vehicle-related incidents.

- Kassel: Also noted for its rising accidents.

- Rotenburg a. d. Fulda: High rates of claims reported.

- Consumers need to reassess their insurance options.

- Informed financial decisions are crucial under these changing market conditions.

With more cities like Weilburg and Limburg a. d. Lahn facing similar challenges, it’s clear that the trend is widespread.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.