BA Stock Remains Volatile While Boeing Bonds Show Resilience

BA Stock Shows Turbulence Amid Strike Challenges

Recently, BA stock has struggled with falling prices, primarily driven by concerns over an ongoing strike and fears regarding a potential downgrade of its credit rating to junk. The impact of these issues has created uneasiness among investors looking at Boeing's stock.

Boeing Bonds Reflect Investor Confidence

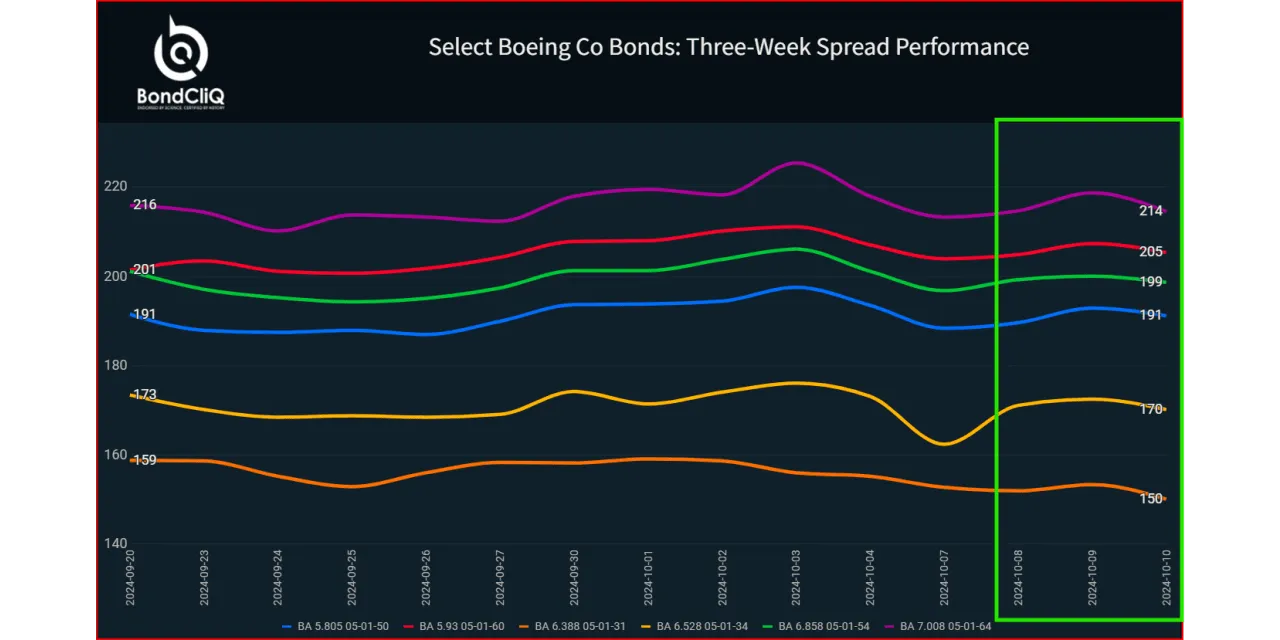

Interestingly, while BA stock declines, Boeing's bonds have demonstrated a contrasting trend. There has been net buying of Boeing bonds, especially in the long-term segment, which suggests a level of investor confidence that is not reflected in the stock price. Furthermore, spreads on these bonds have been tightening, indicating a potential for recovery.

- Key Insights:

- BA stock faces pressure due to operational challenges.

- Boeing bonds are experiencing increased purchasing activity.

- Investor sentiment shifting towards long-term stability.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.