Oil Gains Amid Middle East Conflicts - Market Insights

Understanding Market Reactions to Geopolitical Tensions

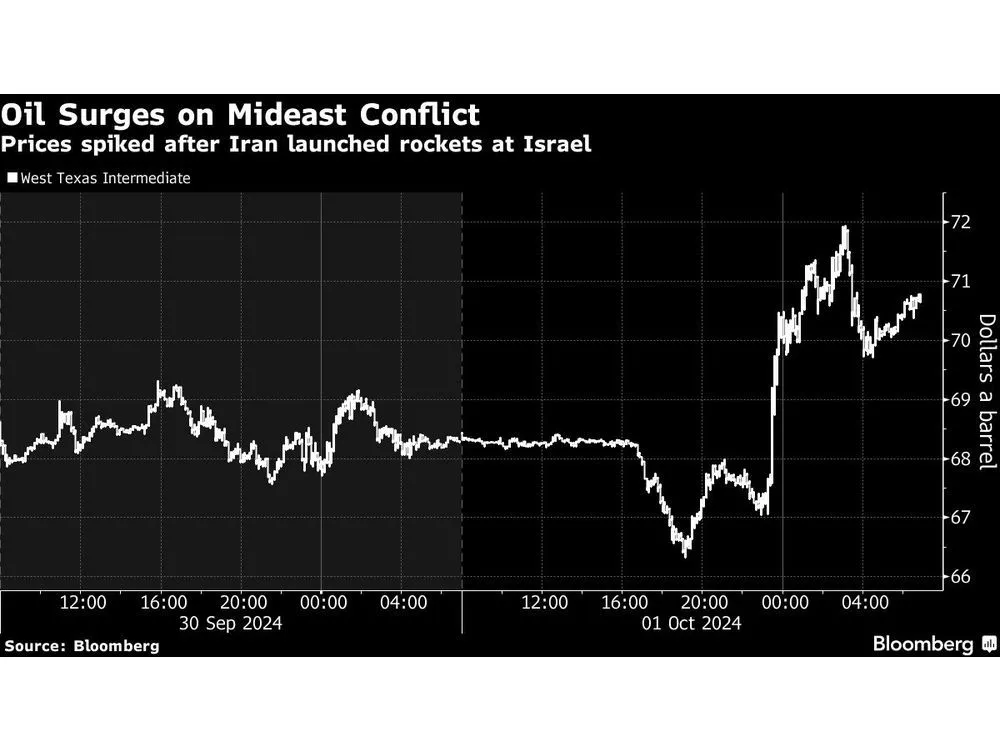

In recent developments, oil prices have surged significantly due to ongoing conflicts in the Middle East. Following a series of missile attacks from Iran targeting Israel, there has been a pronounced flight to safety within financial markets.

Market Impacts: Oil and Stocks

The rise in oil prices is accompanied by a jump in haven assets as investors seek to mitigate risks. Meanwhile, Asian markets, including Hong Kong, have shown mixed reactions amidst these geopolitical tensions.

- Oil Prices Surge: Traders are reacting to supply concerns.

- Asian Stock Fluctuations: Hong Kong stocks align with broader market movements.

Conclusion: Future Market Trends

As the situation evolves, market analysts are closely watching the oil dynamics and stock trajectories in the wake of escalating conflicts. Investors must remain vigilant to navigate potential market volatility.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.