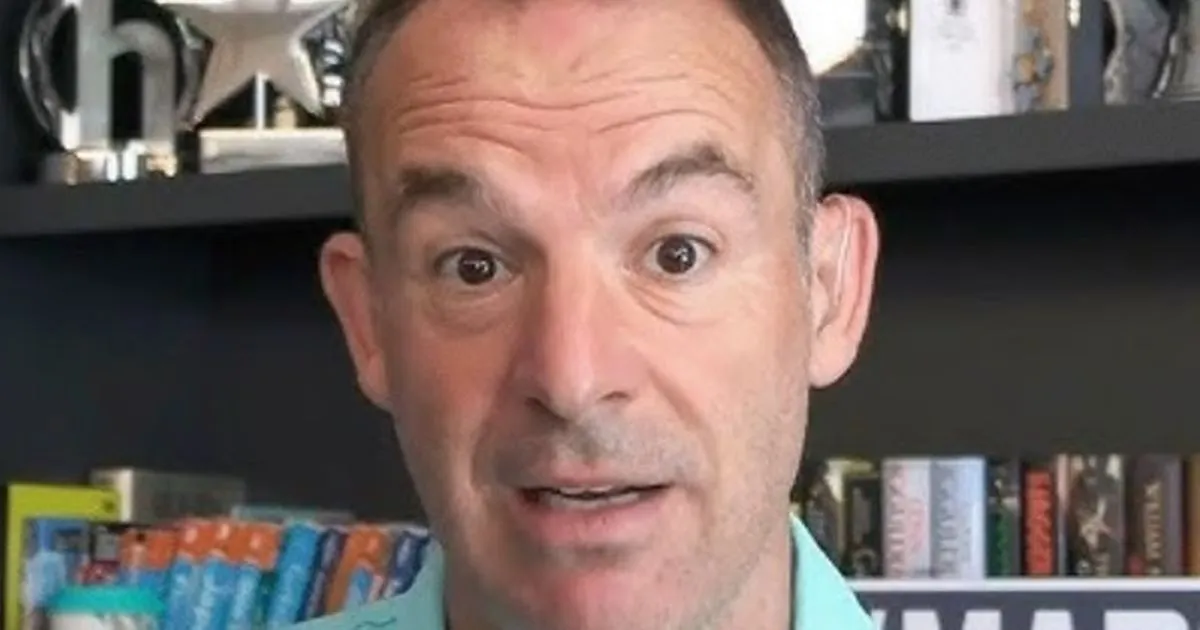

Martin Lewis Advocates for Switching Banks to Maximize Interest Rates

Maximize Savings with Martin Lewis' Recommendations

Martin Lewis, the prominent Money Saving Expert, is making waves as he urges Britons to consider moving their funds to one of four banks that offer better options amidst the expected interest rates cut. As the Bank of England signals changes in the financial landscape, it’s essential to reassess where you keep your cash.

Why Switch Banks?

- Higher Interest Rates

- Improved Current Accounts

- Innovative Banking Apps

Lewis highlights that being strategic about bank selection can help mitigate losses from low returns on savings. Customers should evaluate their current accounts and consider the benefits of switching to banks offering favorable terms.

Key Considerations

- Research available banking options

- Compare interest rates and offers

- Utilize banking apps for easy management

Take action now to safeguard your finances as economic changes unfold. For further information and personalized advice, consider checking Money Saving Expert’s resources.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.