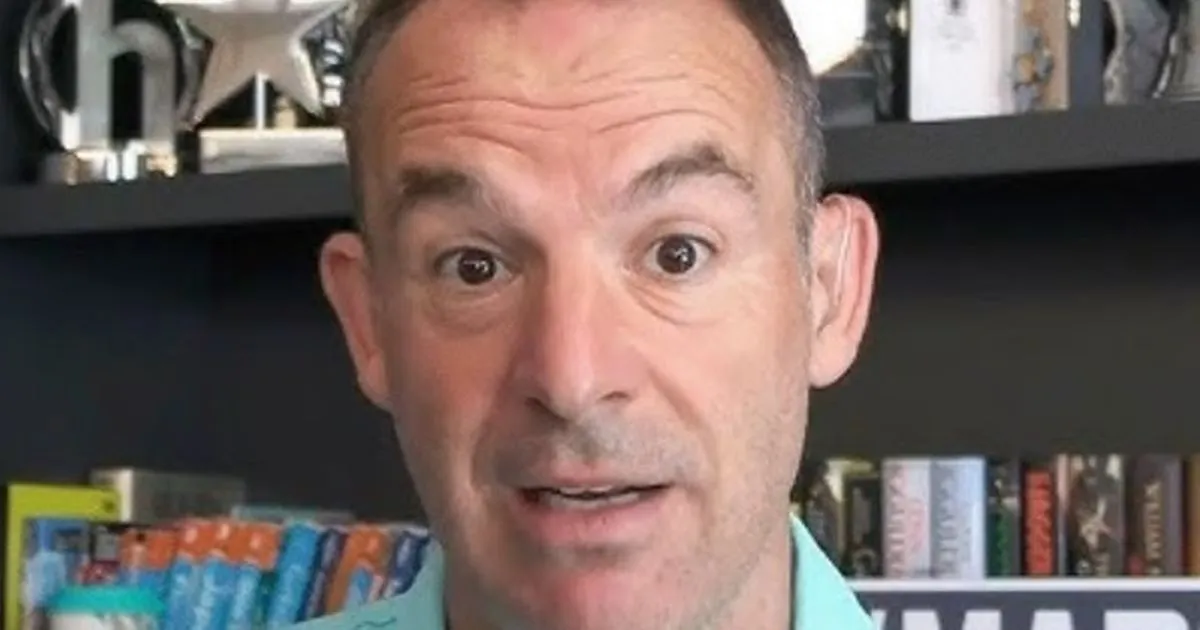

Martin Lewis Mortgage Rates Warning: What You Need to Know

Martin Lewis Mortgage Rates Warning: Essential Insights

In light of recent market fluctuations, Martin Lewis has issued a mortgage rates warning that resonates strongly with both homeowners and prospective buyers.

Why Act Now?

The ongoing variations in mortgage rates necessitate a quick reassessment of financial strategies. Lewis identifies four banks that stand out in this competitive landscape, making them prime candidates for those seeking better deals.

- Bank A: Offers competitive rates and flexible terms.

- Bank B: Customer-centric services with online management.

- Bank C: Attractive incentives for switching.

- Bank D: Special offers for long-term clients.

With the uncertainty surrounding BBC and ITV updates on finance, it's critical to stay informed through trusted channels, including Twitter updates from Martin Lewis himself.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.