Affordable Housing Crisis: The Fed's Role in California's Recovery

Understanding the Affordable Housing Crisis

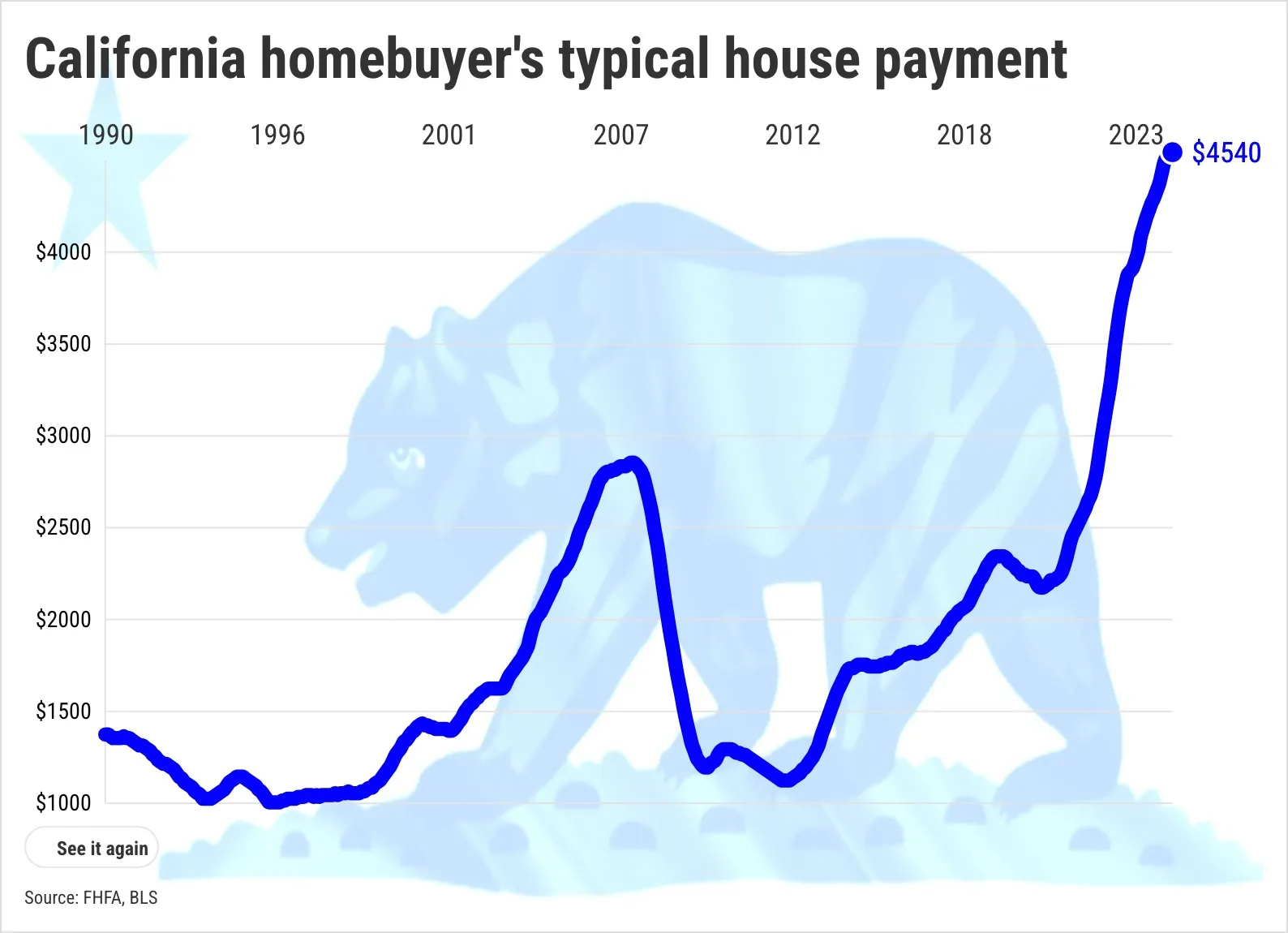

In California, the landscape of affordable housing has hit a troubling point. Currently, homes are selling at a staggering 260,200 annual rate, which is lower than figures recorded during the 2008 global financial crisis and the mid-1990s real estate debacle. The implications for families, communities, and the state economy are dire.

The Fed's Potential Solutions

The Federal Reserve faces the critical task of addressing the affordable housing challenge. To initiate recovery, strategies could include adjusting interest rates and implementing new monetary policies aimed at stimulating housing accessibility. Without intervention, the ramifications for California's residents could perpetuate the cycle of unaffordable living conditions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.