VIX Volume Surge Prompts Cboe to Launch New Volatility Products

VIX Volume Surge Offers New Opportunities

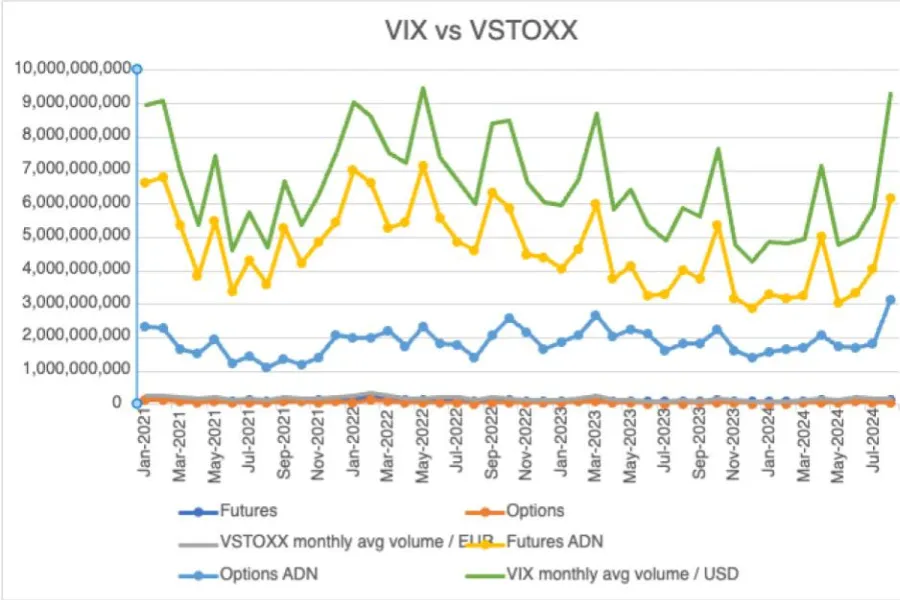

The recent surge in VIX volume is making waves in the finance industry. As demand grows for volatility trading products, Cboe has decided to step up and cater to this interest by unveiling new offerings. This shift indicates a significant adjustment to market trends.

Key Features of Cboe's New Products

- Innovative structures aimed at experienced traders.

- Enhanced methods for managing volatility risk.

- Potential for increased liquidity in the market.

What This Means for Investors

With the introduction of these new products, investors can expect greater flexibility in their trading strategies. This could lead to more tailored approaches as investors react to market changes. Keep a close watch on how these products perform in the coming weeks.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.