TQQQ: The Powerful Investment Tool for Nasdaq 100 Exposure

TQQQ: Navigate Market Opportunities

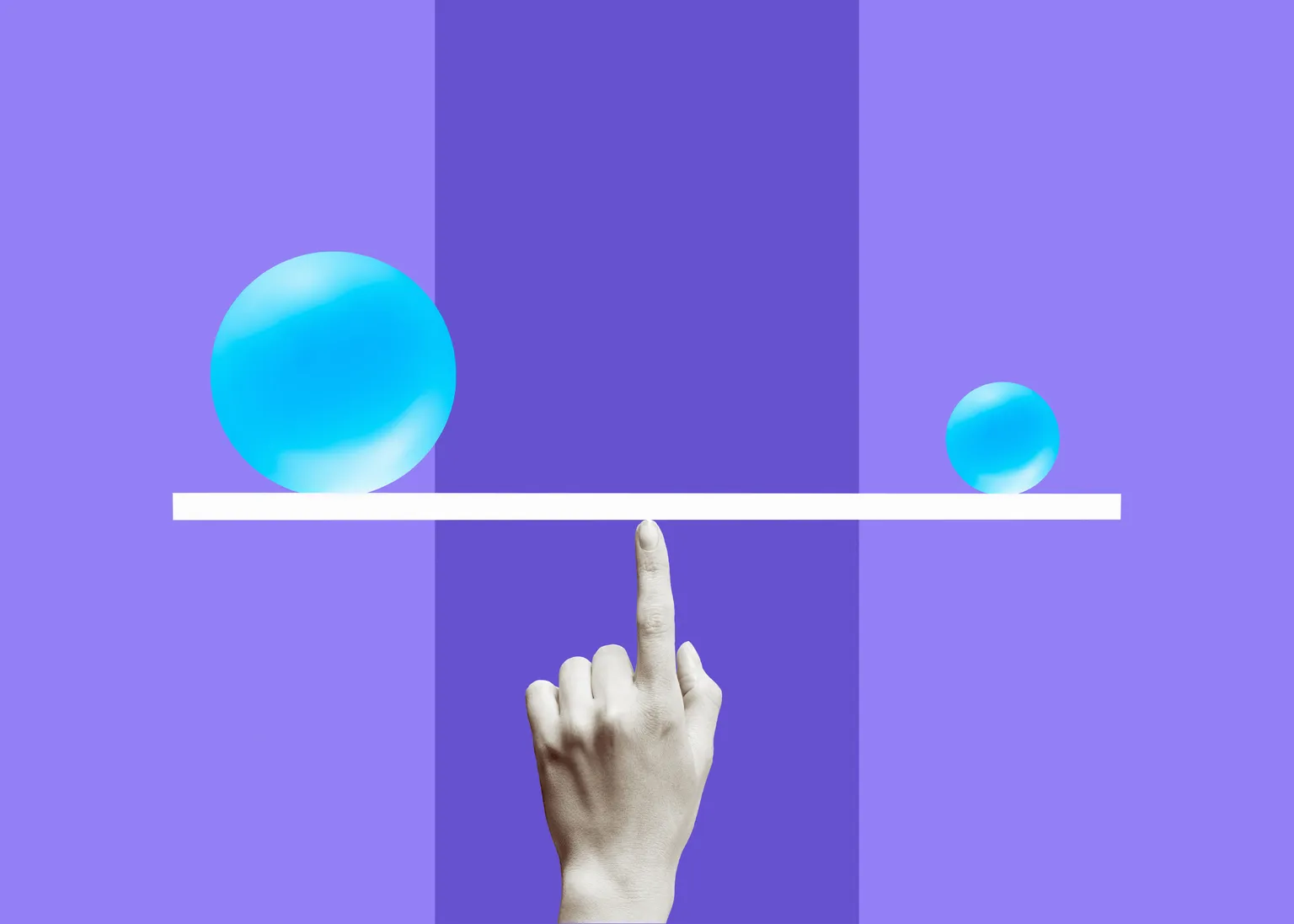

TQQQ, an exchange-traded fund (ETF), offers leveraged exposure to the Nasdaq 100. This means it multiplies returns on the index, which is ripe with technology company stocks, potentially enhancing profits significantly. However, with great potential comes great risk. If the market heads south, losses can also be magnified. Understanding these dynamics is crucial for investors.

Key Benefits of TQQQ

- High potential returns due to leverage

- Direct exposure to top tech stocks

- Rapid trading options for agile investors

Considerations When Investing

- High risk and volatility associated with leveraged ETFs

- Market fluctuations can lead to significant losses

- Regular monitoring is essential to mitigate risks

In summary, TQQQ can be an enticing investment option for those willing to assume increased risk for the potential of greater returns in the thriving technology sector.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.