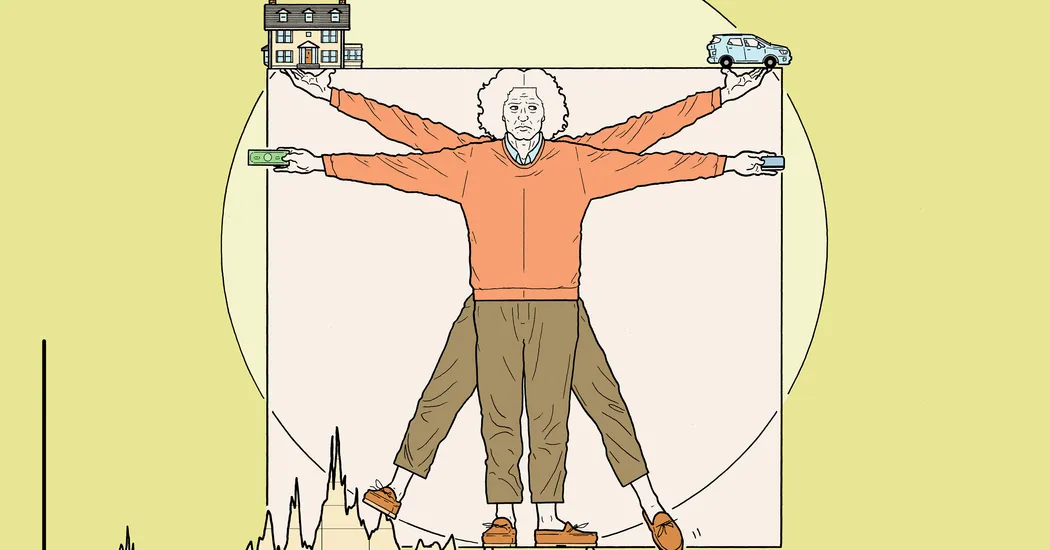

Interest Rates: What You Need to Know About Their Impact on Your Financial Life

Tuesday, 17 September 2024, 09:30

Understanding Interest Rates and Their Effects

As interest rates rise, borrowers will face significant changes in their financial obligations. Here’s how this affects you:

- Mortgage Loans: Higher interest rates can lead to increased monthly payments for homeowners.

- Credit Cards: With fluctuating interest rates, credit card balances will become more costly.

- Cars: Financing a vehicle may become less favorable as rates increase.

- Student Loans: Adjustments in interest rates can impact repayment plans for many borrowers.

- Savings: On the flip side, higher interest rates might benefit savers.

Key Areas of Interest Rate Impact

- Personal Finance: Budget adjustments may be necessary.

- Mortgages: Reassess your refinancing options.

- Credit Card Debt: Consider strategies for managing increasing rates.

For those managing personal finance, staying informed on interest rates and their implications is essential.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.