Sozialabgaben Surge for High Earners: Key Changes Ahead

Understanding the Increase in Sozialabgaben

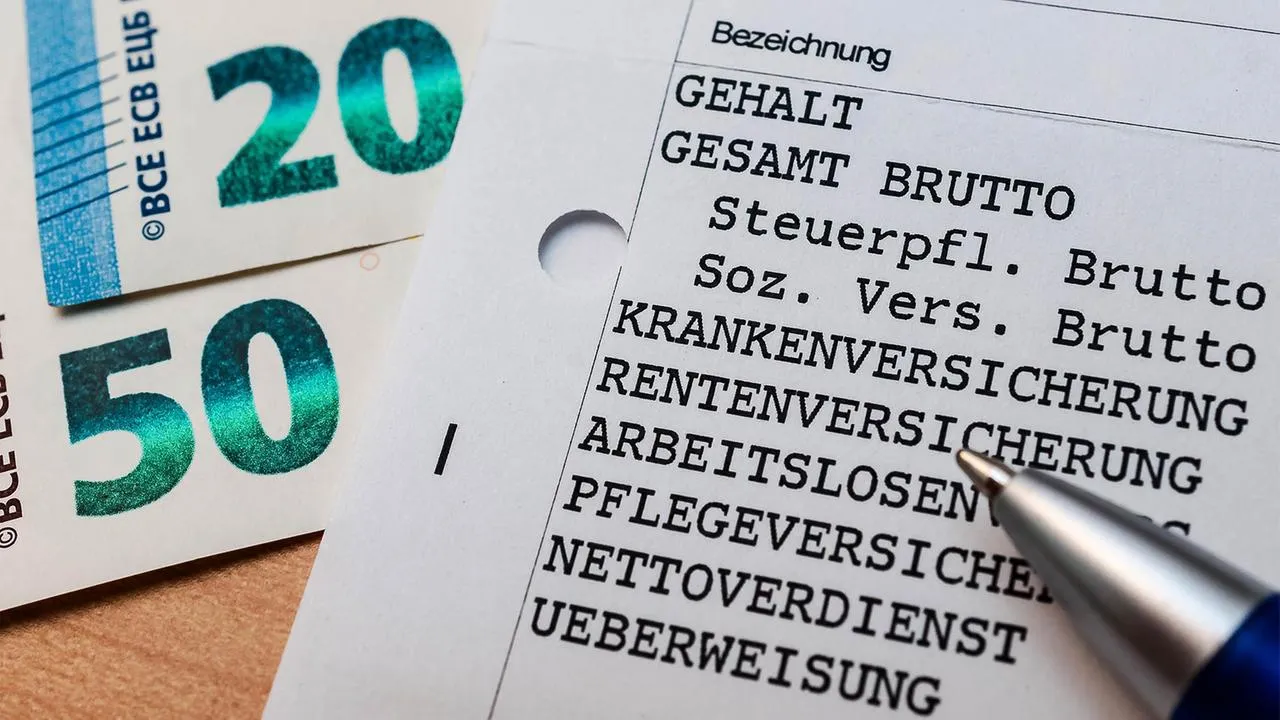

As financial measures evolve, sozialabgaben for high earners might witness a steep rise. This is a pivotal moment affecting not just individuals but also businesses navigating these updated costs. With adjustments in sozialversicherungsbeiträge, the economic landscape could shift dramatically.

Why Are Sozialabgaben Increasing?

- Fiscal Reforms: To address economic challenges, the government considers raising sozialabgaben.

- Income Disparities: The focus on high earners aims to balance income inequalities.

- Future Funding: Ensuring sustainable funding for social programs is critical.

Implications for High Earners

- Higher Deductions: Expect increased deductions from your paychecks.

- Budget Adjustments: Financial planning will need to adapt to these changes.

- Long-Term Benefits: Potential benefits could arise from enhanced social programs.

Stay informed about these significant changes in sozialabgaben. For a deeper analysis of how this may affect your financial situation, we recommend revisiting the source frequently for updates.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.