Weg Stands Out in Brazil's Industrial Sector Amid High Valuation Concerns

Weg's Competitive Edge

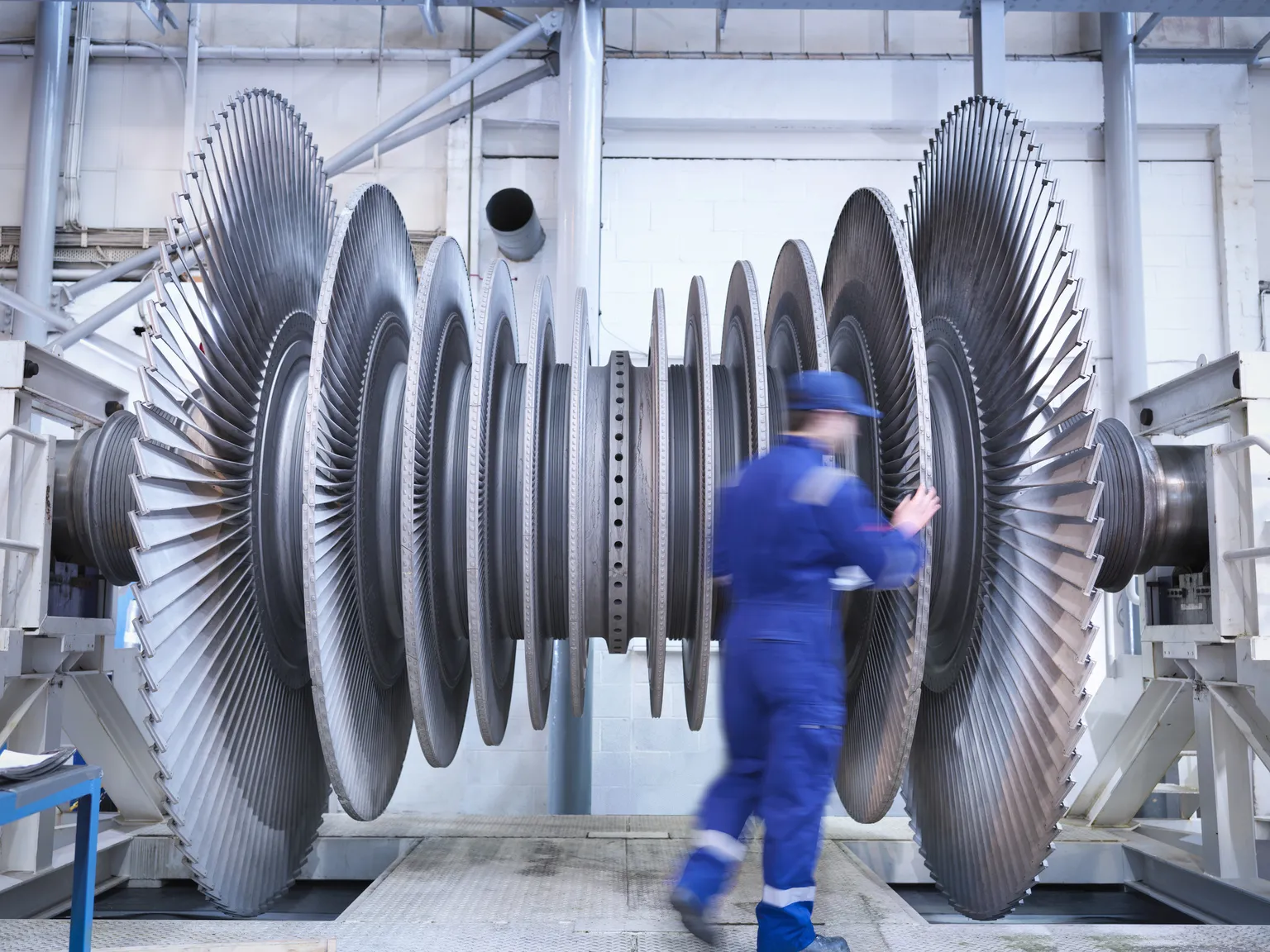

Weg has established itself as a leading industrial company in Brazil. Strong demand for its products has fueled consistent revenue growth. Its commitment to innovation and quality has provided significant competitive advantages over other players in the market.

Valuation Analysis

Despite Weg's impressive performance, analysts are raising concerns about the company's current valuation. With P/E ratios exceeding industry averages, questions arise regarding whether the stock is overpriced. Investors are advised to consider both current profitability and future growth when evaluating their investments.

Key Considerations

- Market Demand: Sustained demand for Weg's products is crucial for maintaining revenue growth.

- Competitive Position: Weg's strong industry position provides a buffer against market fluctuations.

- Valuation Risks: Investors must weigh potential risks associated with high valuation against long-term growth potential.

For more details on Weg's performance and market position, visit a reliable financial news source.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.