GlobalFoundries’ Compounding Mistake Against Taiwan Semi: Behind the Numbers

GlobalFoundries vs. Taiwan Semi: A Financial Overview

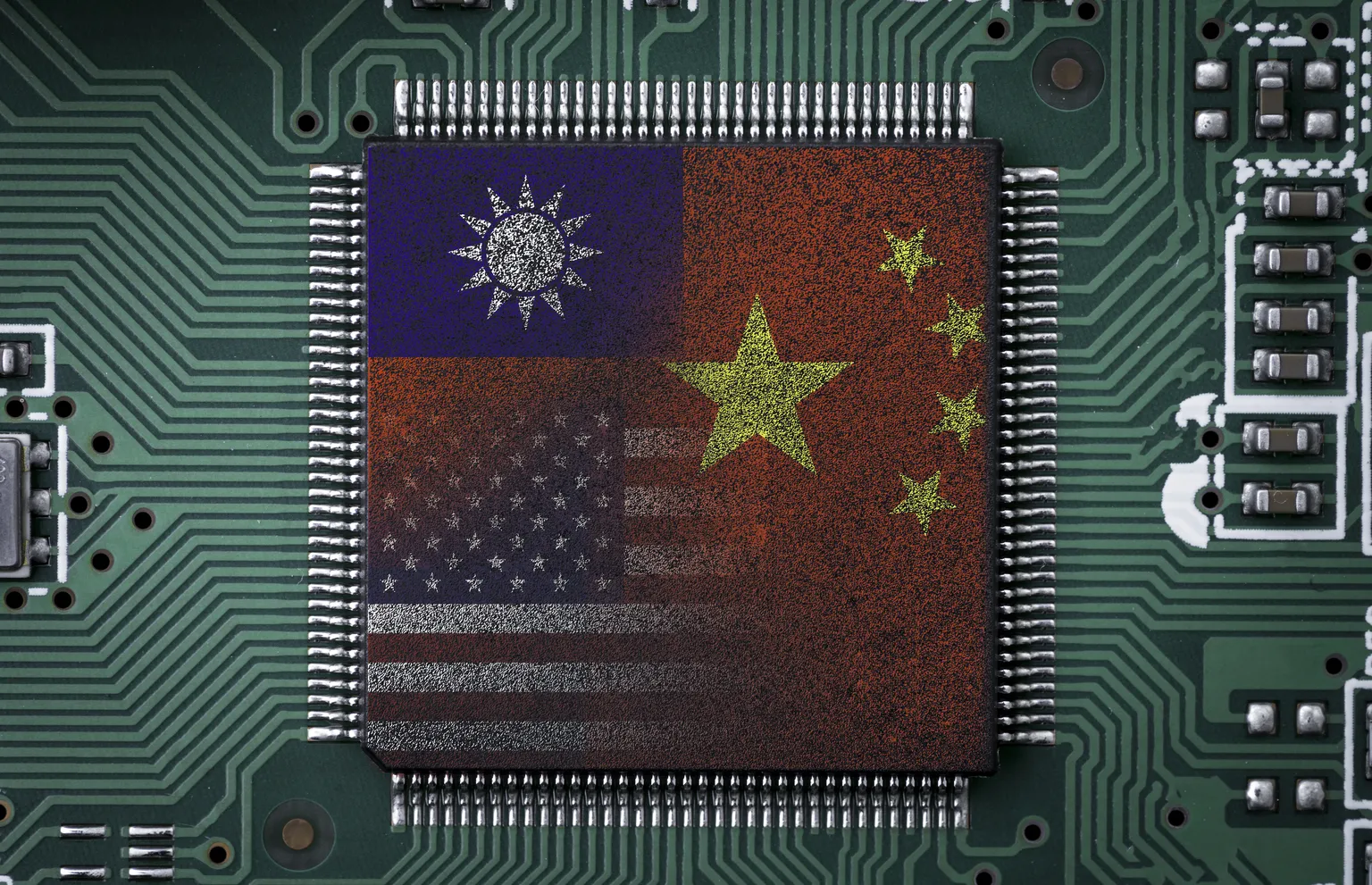

GlobalFoundries continues to grapple with mounting challenges, fueling skepticism about its future. Analysts have flagged the company's valuation difficulties against its rivals, especially Taiwan Semiconductor Manufacturing Company (TSMC), known for its strong market grip. With a projected downside of 12-14%, GlobalFoundries' prospects appear increasingly bleak.

Market Dynamics Affecting GlobalFoundries

- Increasing competition from TSMC highlights GlobalFoundries' weaknesses.

- Inconsistent revenue streams exacerbate investor concerns.

- Strategic missteps in operations may hinder long-term growth.

Investment Outlook

Given the current valuation challenges and competitive pressures, many analysts recommend a Hold rating on GlobalFoundries (NASDAQ:GFS). Investors should closely monitor the evolving landscape to make informed decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.