Tech Startups Innovate: PastPay Secures $13.3 Million for BNPL Services

Transforming Payments: The Rise of PastPay

Tech startups are continuously disrupting traditional financial systems, and PastPay is no exception. This Hungarian fintech has successfully raised $13.3 million in its Series A funding to enhance its services that cater to businesses needing flexible payment terms.

Understanding Buy-Now, Pay-Later for Businesses

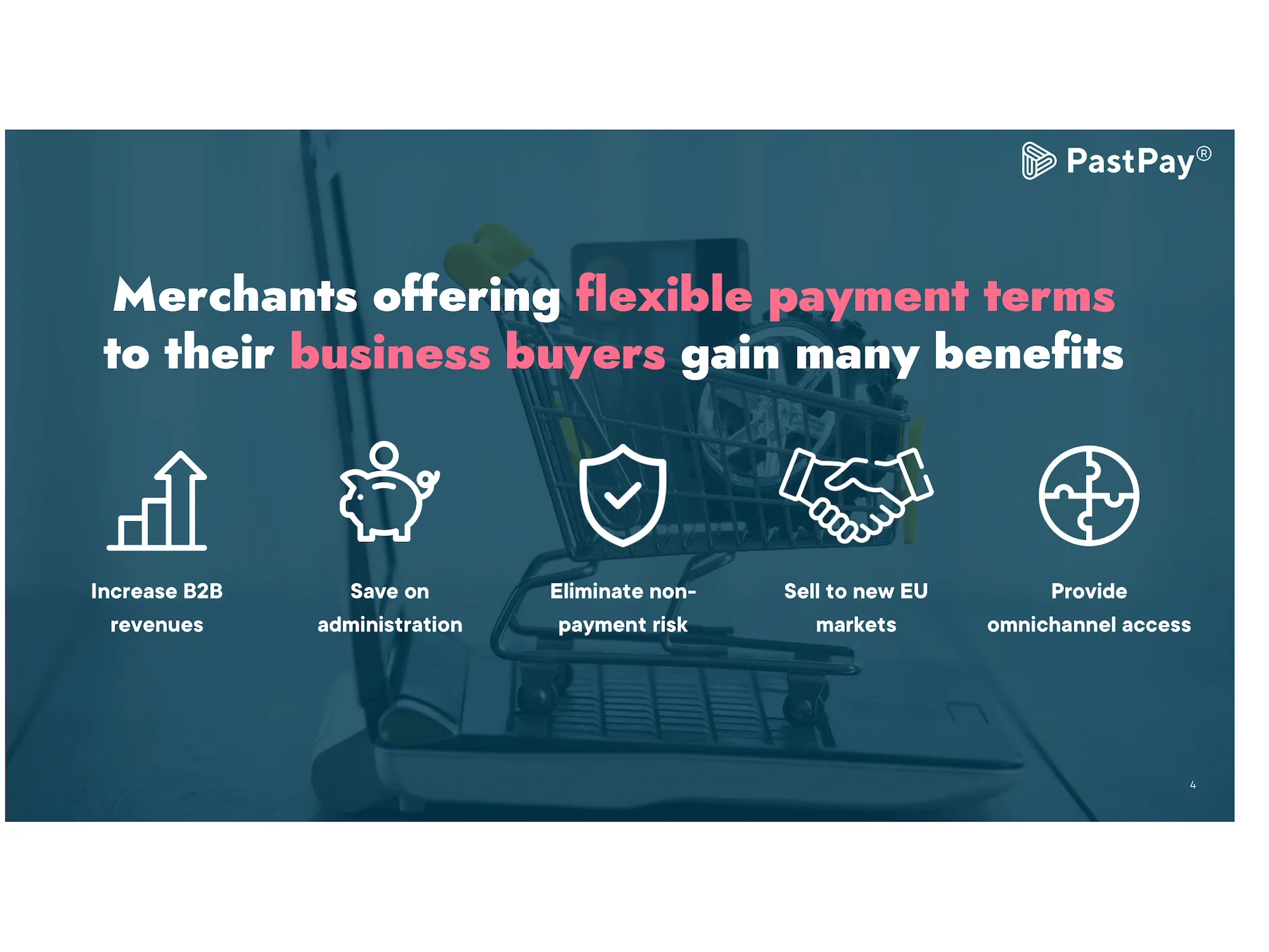

With a focus on buy-now, pay-later (BNPL) options for invoices, PastPay is tackling the challenges of delayed payments. Typically, companies face payment windows ranging from 15 to 90 days. With PastPay, merchants can receive cash for outstanding invoices within 24 hours, ensuring improved cash flow and liquidity.

Market Potential and Growth

The demand for B2B BNPL solutions is surging as part of a broader push to digitize payments. According to Benjamin Berényi, CEO of PastPay, small and medium-sized businesses are currently underserved in this market.

Conclusion: A Bright Future for Fintech Startups

PastPay's funding success emphasizes the opportunity for tech startups in the fintech landscape. As businesses continue to seek efficient payment solutions, innovations like PastPay's services will play a critical role in shaping the industry's future.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.