Investment Strategy for Markets: Analyzing the VanEck Semiconductor ETF's Historic Decline

Investment Strategy Overview

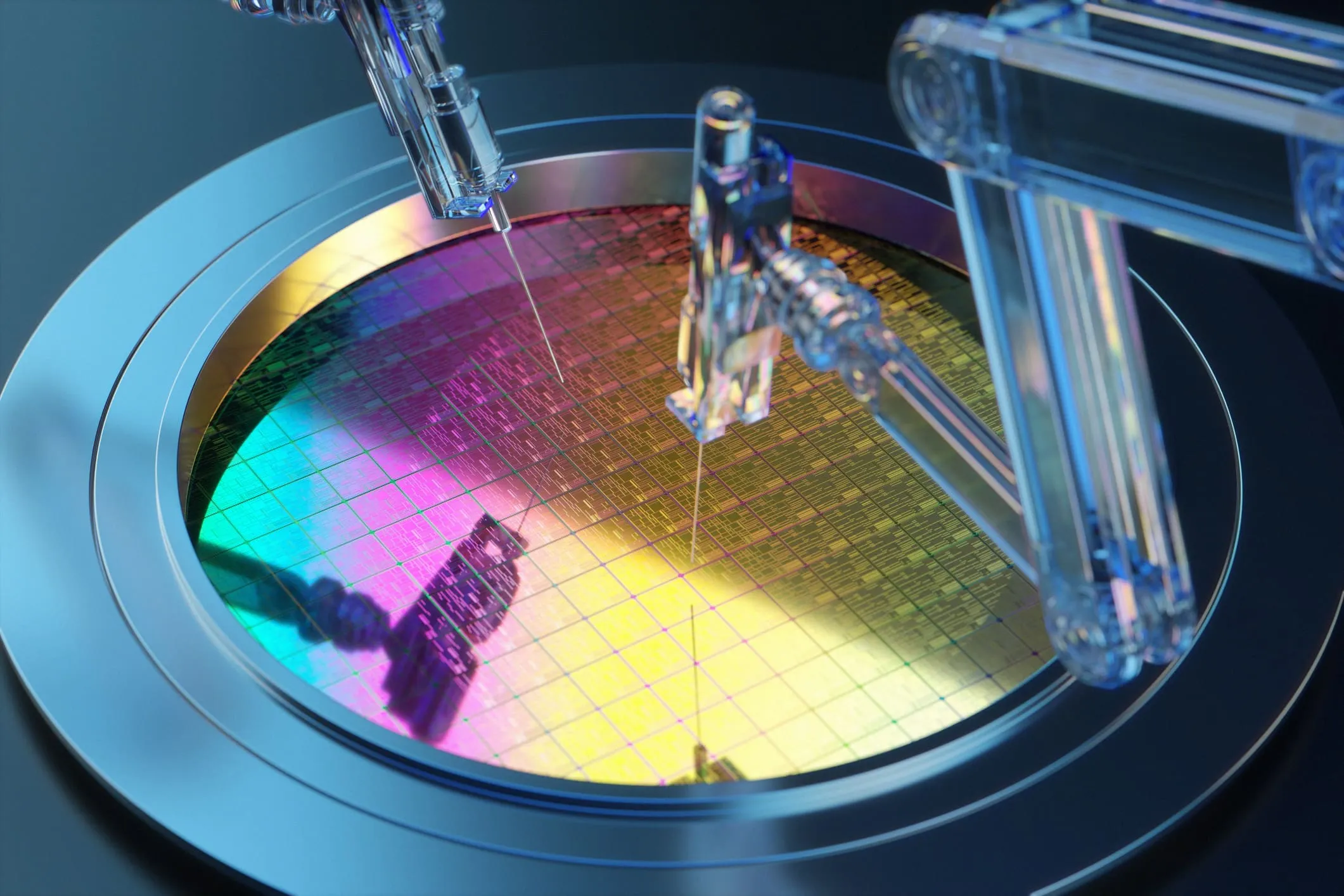

The semiconductor market faced a significant jolt last week, with the VanEck Semiconductor ETF falling more than 11%, marking its worst week since 2020. This sharp decline has stirred concerns across various sectors, focusing investor attention on prominent players like Intel Corp, Nvidia Corp, and Taiwan Semiconductor Manufacturing Co. Ltd.

Market Insights and Implications

While the dip in the VanEck Semiconductor ETF raises questions, Wall Street analysts remain optimistic about the long-term potential of chip stocks. Broadcom Inc and Advanced Micro Devices Inc are highlighted as key players that may offer significant returns as the industry stabilizes. Investors are urged to reassess their investment strategies to capitalize on potential rebounds.

Future Trends to Watch

- Investment strategies need adaptation amidst market fluctuations.

- The performance of major companies like Intel Corp could define market recovery.

- Analysts predict volatility but encourage discernment in stock selection.

For more details on the developments in semiconductor investments, visit reliable tech news sources.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.