Stocks and Bonds: A Return to Historical Trends Amidst Inflation

Stocks and Bonds: Historical Relationship and Recent Developments

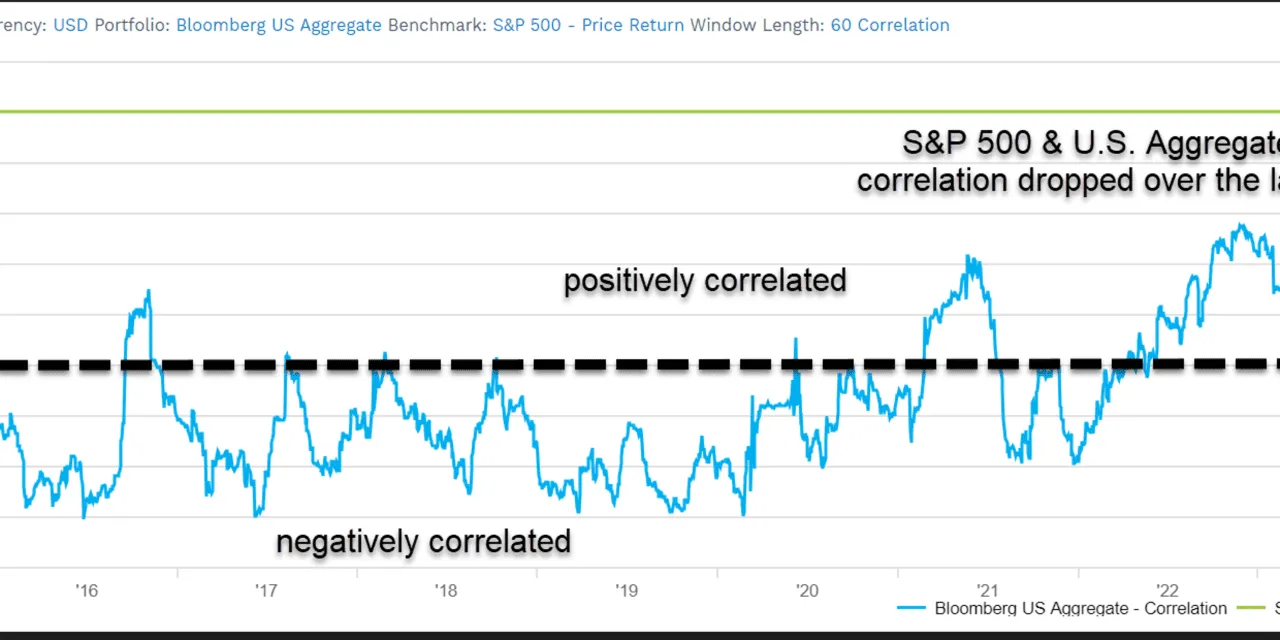

Stocks and bonds are getting back to their opposite groove as high inflation challenges their typical dynamics. Fixed income generally acts as a buffer against decreasing equity values, but recent market conditions reveal both asset classes declining simultaneously due to aggressive rate hikes from the Federal Reserve. The connection is reestablishing itself, highlighted by insights from Emily Roland and Matt Miskin, co-chief investment strategists at John Hancock Investment Management.

Understanding the Current Market Dynamics

- The pandemic disrupted traditional asset behaviors.

- Investors are witnessing a significant shift as stocks and bonds realign.

- Expert analysis shows improved correlation metrics between S&P 500 and U.S. Aggregate bonds.

The Future Outlook for Investors

As the market continues to respond to inflation, potential shifts in investment strategies may emerge. Investors should remain vigilant about stocks, bonds, and their evolving relationship.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.