Stocks and Bonds Relationship: Reverting to Historical Patterns

Understanding the Stocks and Bonds Dynamic

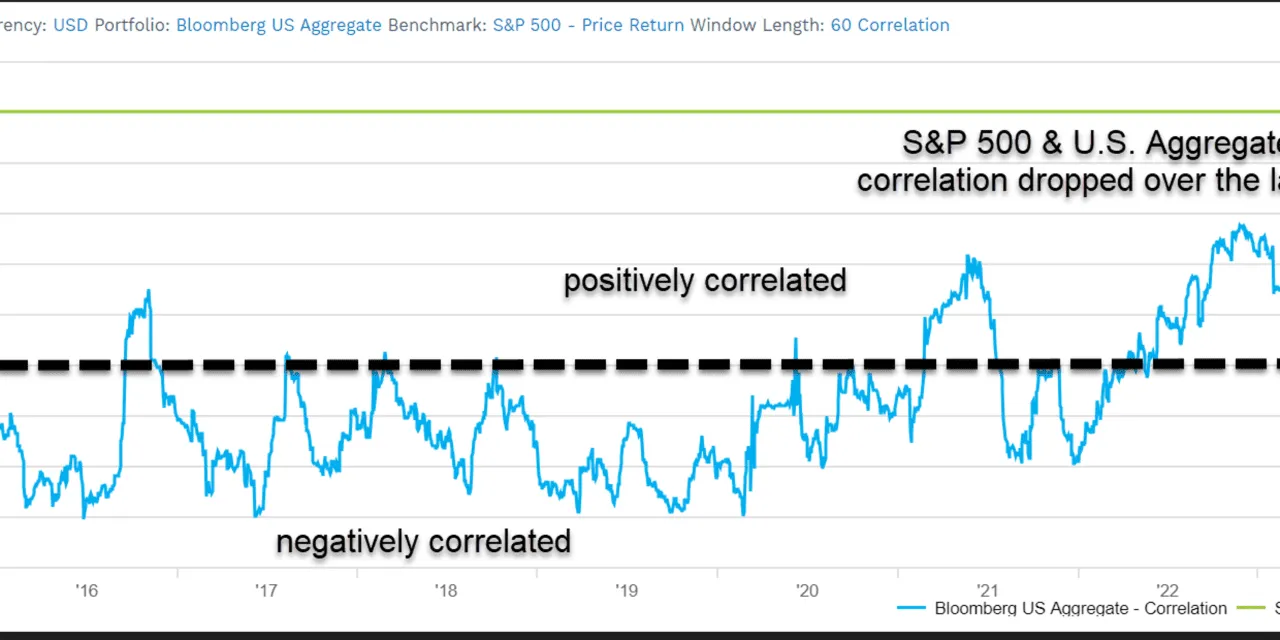

The relationship between stocks and bonds has shifted significantly due to high inflation and an era of low interest rates. Typically, fixed income assets serve as a hedge against falling equity prices, but recent trends show both asset classes reacting negatively to economic pressures.

Readjusting Patterns Post-Pandemic

- Post-pandemic economic shifts

- The Federal Reserve's role in rate adjustments

- Insights from market experts, Emily Roland and Matt Miskin

According to Emily Roland and Matt Miskin, co-chief investment strategists at John Hancock Investment Management, the rolling 60-day correlation between the S&P 500 index and the U.S. Aggregate bond index is beginning to demonstrate a reversion to historical norms.

- Investors should monitor the correlation patterns closely.

- The recovery of traditional bonds as an offset to stocks could reshape market strategies.

Conclusion: The Future Outlook

The adjustment of stocks and bonds to their historical interaction presents fresh opportunities for strategic investment. Investors are advised to remain vigilant as further changes could emerge.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.