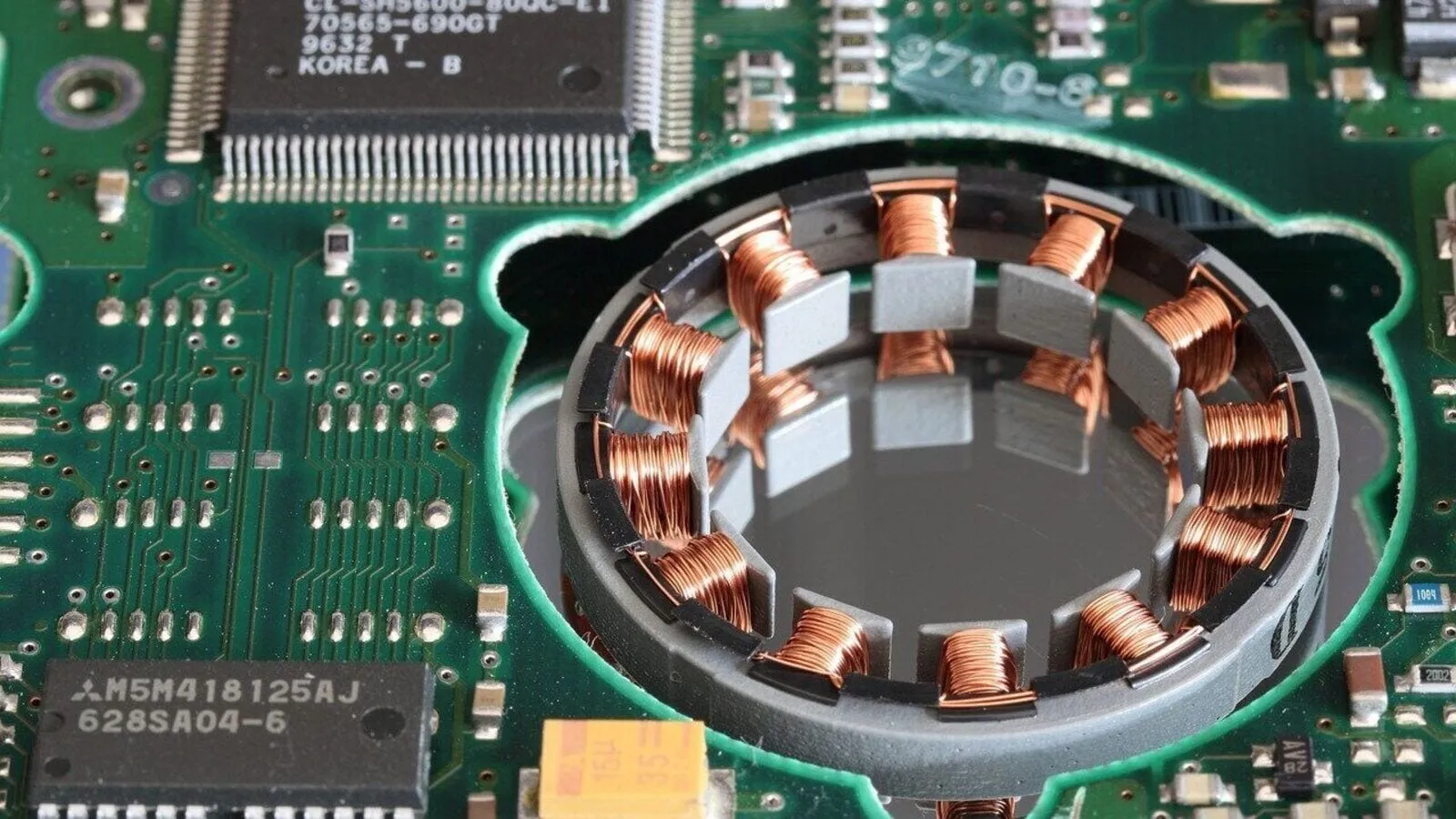

Electronics Manufacturing Services Stocks Soar: PG Electroplast and Dixon Technologies Lead the Charge

Growing Opportunities in Electronics Manufacturing Services

Electronics Manufacturing Services (EMS) stocks are witnessing a remarkable surge, with PG Electroplast and Dixon Technologies leading the charge in 2024. PG Electroplast’s shares have soared by 140%, climbing from ₹237.36 to ₹567, while Dixon Technologies has recorded a stunning 96% return. This trend underscores the impressive growth of India’s EMS sector, which is increasingly recognized as a vital hub for manufacturing and exports.

Performance Driven by Strategic Initiatives

The Indian EMS landscape is being significantly influenced by favorable policies like the Production-Linked Incentive (PLI) scheme. The momentum is further fuelled by the ongoing “China+1” strategy that enhances India’s production capabilities on the global stage. Recent estimates suggest the global electronics industry could reach $3.1 trillion by CY26, with the EMS sector expected to grow even faster at a CAGR of 5.4%, potentially reaching $1.1 trillion.

- Kaynes Technologies also reported substantial gains, with share prices rising by 92% from ₹2,600 to ₹5,019.

- Elin Electronics and Amber Enterprises have achieved impressive growth rates of 49% and 35%, respectively, during the current year.

Strong Market Performance Indicators

Recent reports by Systematix Institutional Equities highlighted significant year-on-year growth across multiple companies, particularly in revenue and PAT for the first quarter. The analysis indicates a robust demand trend powered by cooling product sales, positioning these EMS stocks as prime targets for investors.

Future Outlook and Analyst Ratings

Brokerage firms have taken a keen interest in Dixon Technologies and Amber Enterprises, giving them ‘buy’ ratings with ambitious target prices of ₹15,000 and ₹5,000, respectively. These projections reflect confidence in their strategic diversification into electronics and innovative partnerships aimed at expanding market share.

For a more detailed insight, visit industry expert sources and consider professional advice before making investment decisions!

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.