Tencent Divests from UK Fintech Tide: Analyzing the Implications

Tencent Sells Stake in Tide: Key Highlights

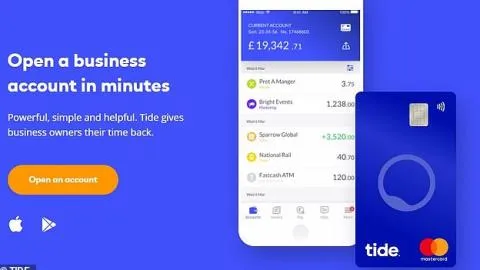

The Chinese tech giant Tencent has recently sold its 14% stake in the UK-based fintech company Tide. This divestment has captured significant attention, given the implications it may have on the fintech landscape.

Factors Behind the Decision

- Shifting investment strategies

- Fluctuating market conditions

- Impact on investor sentiment

Conclusion

This move by Tencent reiterates the complexities in global investment strategies within the fintech sector. As market conditions evolve, Tide and similar companies must navigate the new landscape shaped by such significant exits.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.