Why Investing in Biotech and Pharma Stocks During Market Sell-Offs Is Wise

Why Invest in Biotech and Pharma During Market Fluctuations

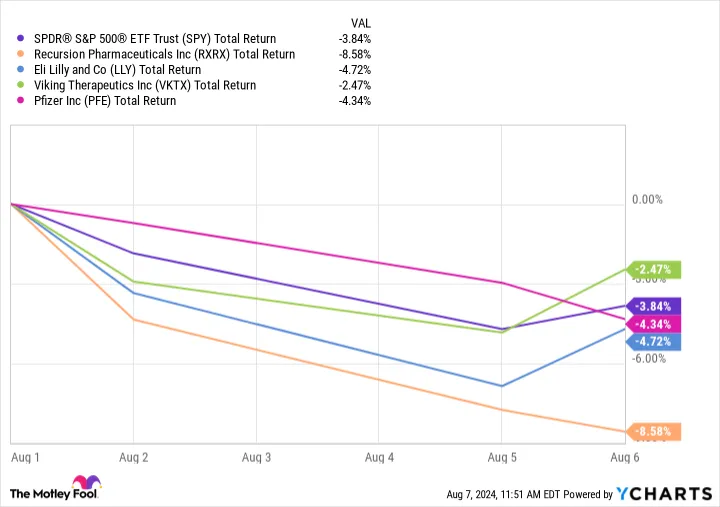

Investing in biotech and pharma stocks during sell-offs allows investors to capitalize on market corrections. Biotech firms often exhibit remarkable resilience, recovering from downturns faster than many other sectors. Over time, these industries show strong growth, driven by innovation and demand for healthcare solutions.

Key Factors to Consider

- Proven Resilience: Historically, these stocks recover swiftly.

- Innovation Pipeline: Continuous advancements keep growth prospects alive.

- Market Demand: An increased focus on health guarantees sustained investments.

In summary, buying biotech and pharma stocks during market sell-offs stands out as a strategic move for investors aiming for long-term success. Monitoring both sectors beyond immediate fluctuations may lead to lucrative investment opportunities.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.