Mortgage Rates Surge Again, Ending Monday’s Decline

Current Trends in Mortgage Rates

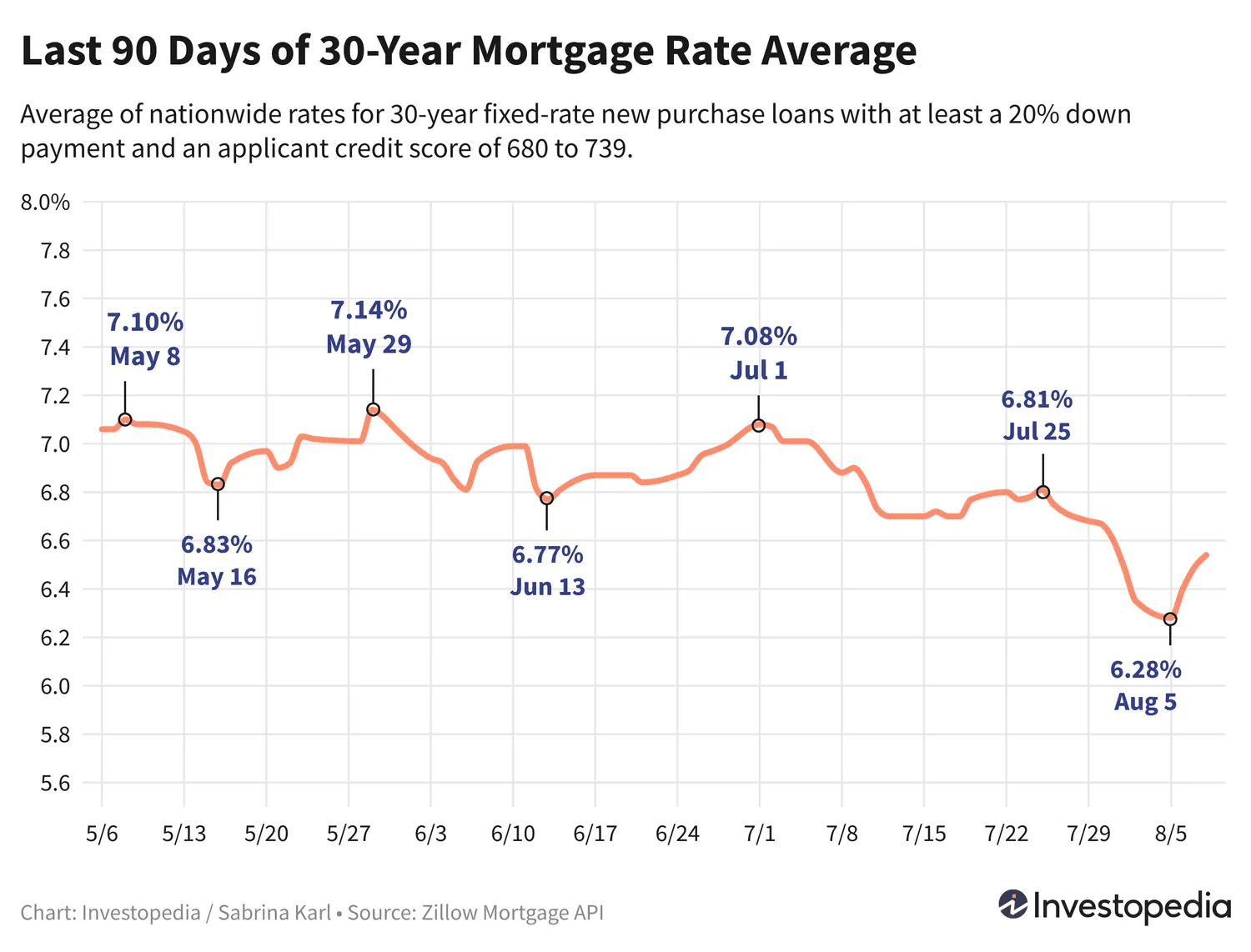

After experiencing a notable decline on Monday, mortgage rates are on the rise once again.

Details of the Rate Increase

The average rate for a 30-year mortgage now stands at 6.54%. This is the result of three consecutive days of increases following a drop to the lowest levels seen since April 2023.

Impact on the Mortgage Market

- Most loan types are also experiencing rising rates.

- This trend raises questions about future buying power and market stability.

Conclusion

The recent rise in mortgage rates indicates a potential turning point for the housing market, affecting both buyers and sellers.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.