Understanding the Dot-Com Bubble's Relevance to the AI Era

Exploring the Parallels Between the Dot-Com Era and AI Today

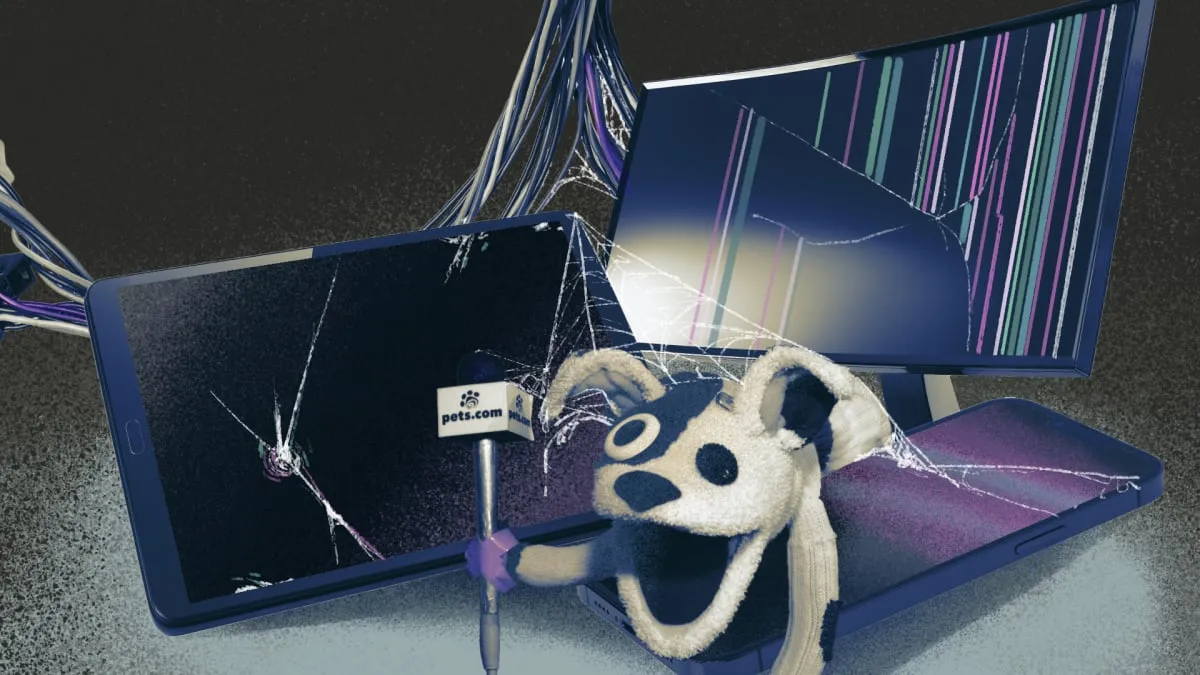

The dot-com bubble burst remains relevant today, particularly as AI stocks face dramatic declines in a market once driven by overwhelming optimism. Just as the dot-com bubble was characterized by a mix of excitement and eventual disillusionment, today's landscape also shows signs of inflated expectations meeting harsh realities.

The Timing and Nature of Bubbles

- History shows that market declines often occur gradually, rather than abruptly, as seen in both the dot-com era and the current AI market.

- Investor sentiment can dramatically shift as the market begins to reassess underlying values.

- Key events, such as major acquisitions and antitrust actions, play pivotal roles in shaping market perceptions.

Lessons Learned

In reflecting on these events, it becomes clear that the lasting impact of a bubble is often felt long after its initial burst, and the recovery can pave the way for new innovations.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.