Billionaires' Tax Debate Intensifies: Insights from Leading Economists

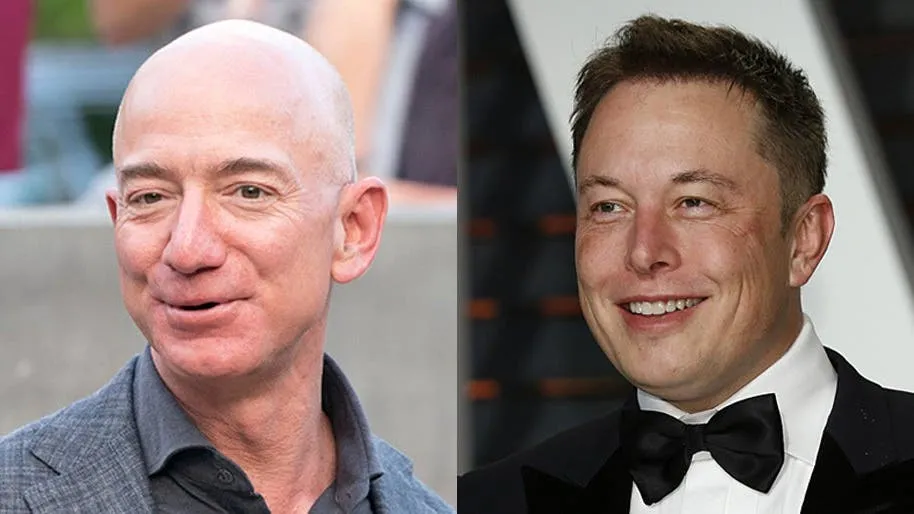

Billionaires and Wealth Inequality

As the rich wield their clout and garner a disproportionate share of the global wealth, economists are advocating for a minimum tax on billionaires.

The Proposal

An economist mentioned that the 2% minimum billionaires' tax could soon become a reality. This tax aims to address wealth inequality and ensure that the ultra-wealthy contribute fairly to society.

Implications of the Tax

- Wealth Distribution: This tax could improve wealth distribution.

- Economic Stability: Increased tax revenue may lead to investments in public services.

Conclusion

This proposal marks a significant shift in fiscal responsibility and may pave the way for future reforms targeted at wealth equality.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.