Understanding NVIDIA’s Market Cap Decline and Institutional Investor Perspectives

NVIDIA Corporation's Market Cap Fluctuation

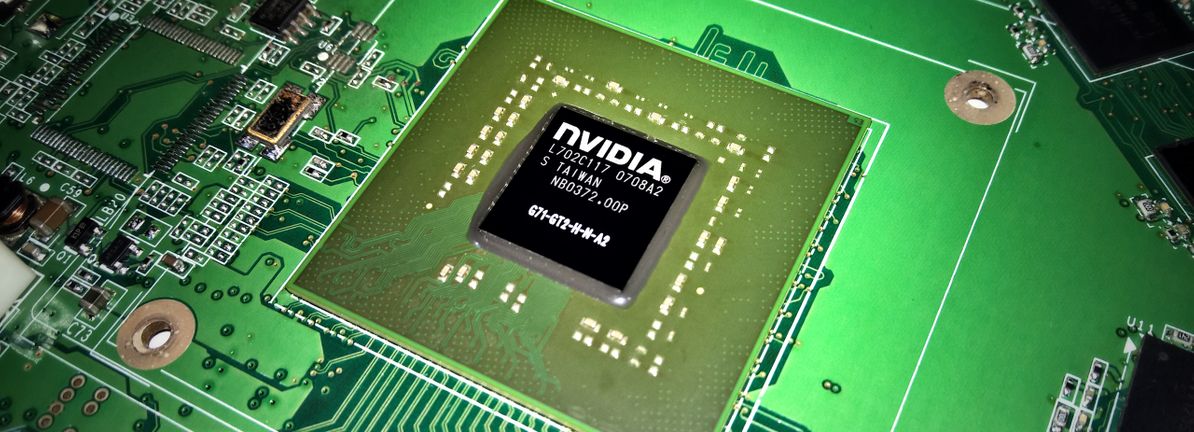

NVIDIA Corporation has recently experienced a significant market cap decline of US$258 billion. This event raises questions regarding the reactions of institutional investors who hold a substantial portion of NVIDIA's stock.

Impact of Institutional Ownership

- High institutional ownership suggests that the stock price reacts strongly to trading by these entities.

- Long-term profits, however, remain in the green, leading to a potentially relaxed response among investors.

- Investors appear to prioritize future growth over short-term market fluctuations.

Conclusion

Despite the recent decline in market cap, institutional investors may be exhibiting confidence in NVIDIA’s longer-term profitability, which could signal enduring interest in the company.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.