Is Intel Stock (NASDAQ: INTC) Undervalued? Analyzing its 0.6x PEG Ratio

Overview of Intel's Stock Performance

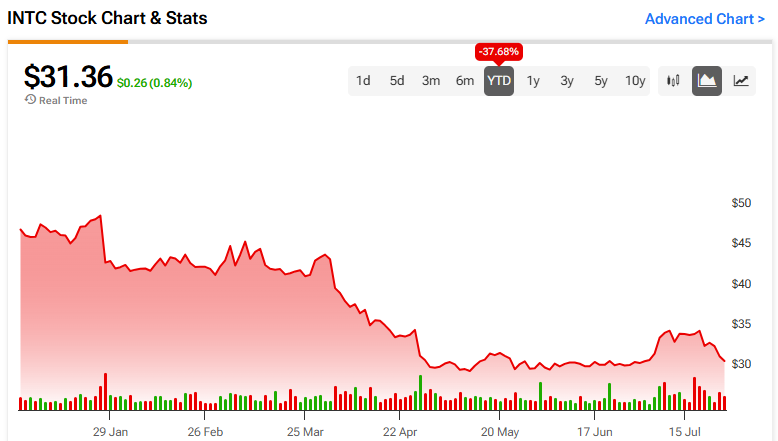

Intel (INTC) has underperformed significantly in the chip-making industry in recent years. As of today, it has declined 37.7% since the beginning of the year and 32% over the last five years.

Valuation Metrics

Despite the drop, Intel's current stock valuation appears increasingly attractive. The forecasted growth in its Client Computing Group (CCG) and Data Center and AI Group (DCAI) provides a positive outlook.

- Current forward earnings: 30.3x non-GAAP

- Price-to-Earnings-to-Growth (PEG) ratio: 0.6x

- PEG ratio of 1.0x or less is typically seen as undervalued.

- Investors should consider Intel as a strong buy opportunity.

Conclusion

With a low PEG ratio and potential growth areas, Intel's stock is worth a closer look for value investors seeking opportunities in the semiconductor market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.