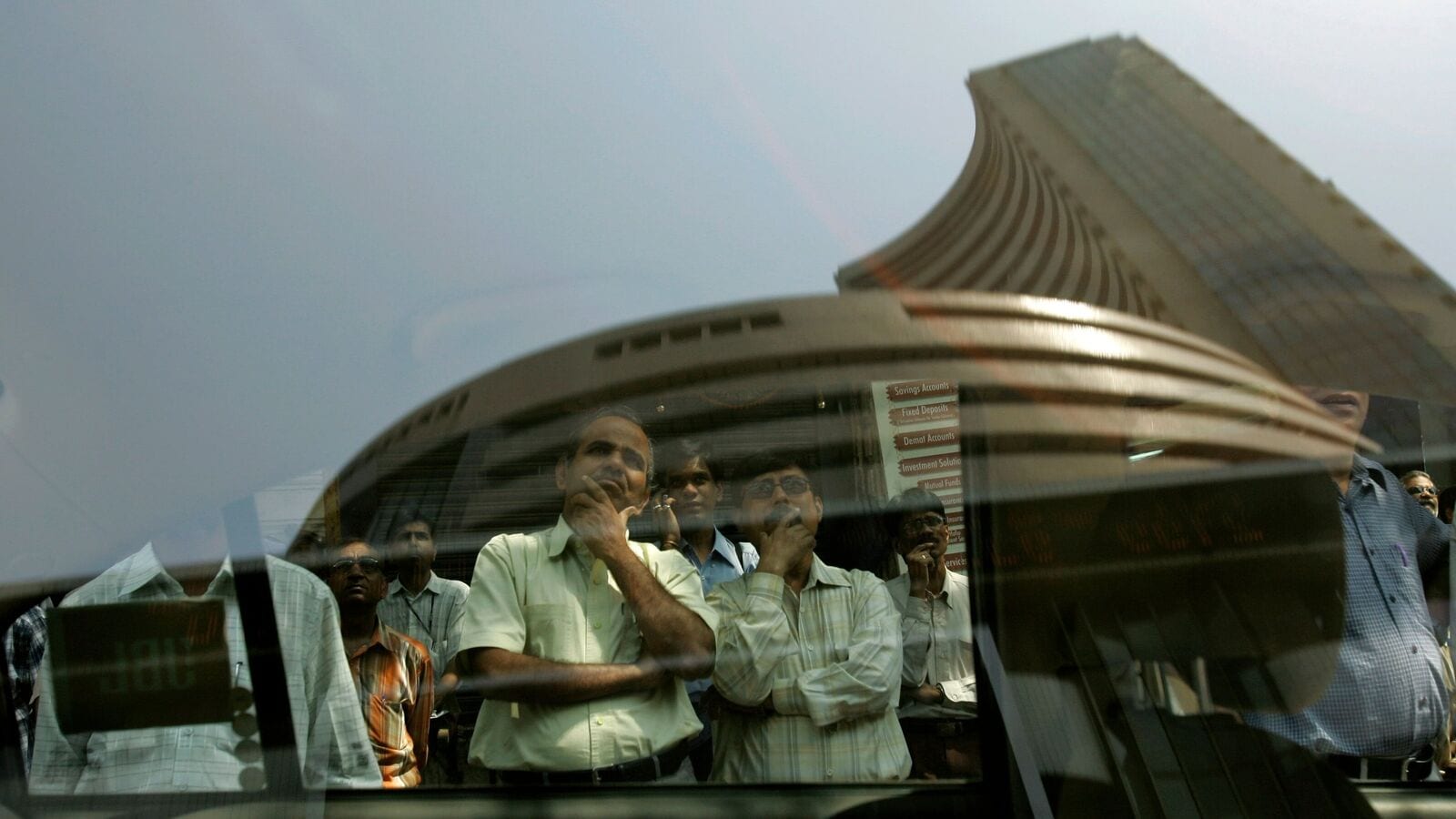

India's Stock Exchanges Remain Unscathed During Global Cybersecurity Crisis

Resilience in the Face of Adversity

In a recent cybersecurity incident that caused turmoil in financial markets across the globe, India’s BSE and NSE remained unaffected. This surprising resilience can be attributed to several factors:

- Lower IT Spending: Despite spending significantly less on IT compared to their global counterparts, India's stock exchanges managed to maintain operational stability.

- Strategic Infrastructure: The robust infrastructure and contingency plans in place played a crucial role in avoiding the 'blue screen of death' incident.

- Expertise and Preparedness: Skilled professionals in the Indian financial sector demonstrated effective crisis management strategies that kept the exchanges running.

Conclusion

Overall, the resilience shown by India's BSE and NSE during this cybersecurity crisis not only underscores the strength of their systems but also raises questions about the necessity of high IT spending. Their success is a beacon for other financial institutions worldwide.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.