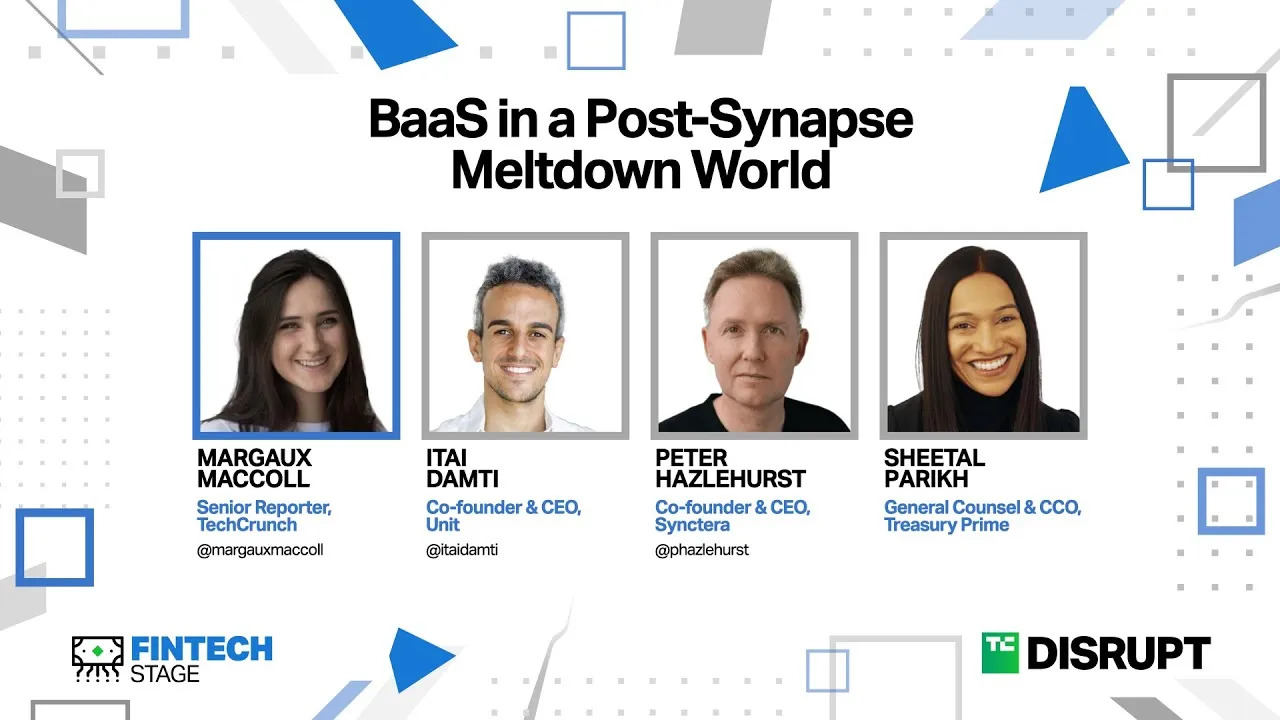

TechCrunch Disrupt 2024: Analyzing the Impact of the Synapse Meltdown on Banking-as-a-Service

TechCrunch Disrupt 2024: The Shifting Landscape of Banking-as-a-Service

In the wake of Synapse's bankruptcy, the banking-as-a-service (BaaS) sector faces unprecedented challenges. This event not only affected the operations of many fintech startups but also raised questions about the interdependence within the tech ecosystem. As consumers grapple with the fallout, the need for regulatory clarity becomes paramount.

The Ripple Effects of the Synapse Meltdown

- Startup Impact: Numerous startups reliant on Synapse’s infrastructure have either faltered or collapsed.

- Consumer Trust: Many users are re-evaluating their faith in digital banking solutions.

- Regulatory Discussions: Analysts advocate for clearer regulations to safeguard consumer interests.

As we gather insights from TechCrunch Disrupt 2024, it’s clear that the path forward is fraught with both challenges and opportunities for industry innovation.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.