AI Stock Insights: Uncovering ASML's Competitive Edge

AI Stock Surge: Analyzing ASML's Performance

AI stocks are making waves in the market, and ASML is at the forefront of this movement. Following a revenue growth dip to just 1% in Q4 2022, ASML's stock has remarkably skyrocketed over 80%. This demonstrates the resilience and potential of ASML as a top player in the tech sector.

Key Factors Behind ASML's Success

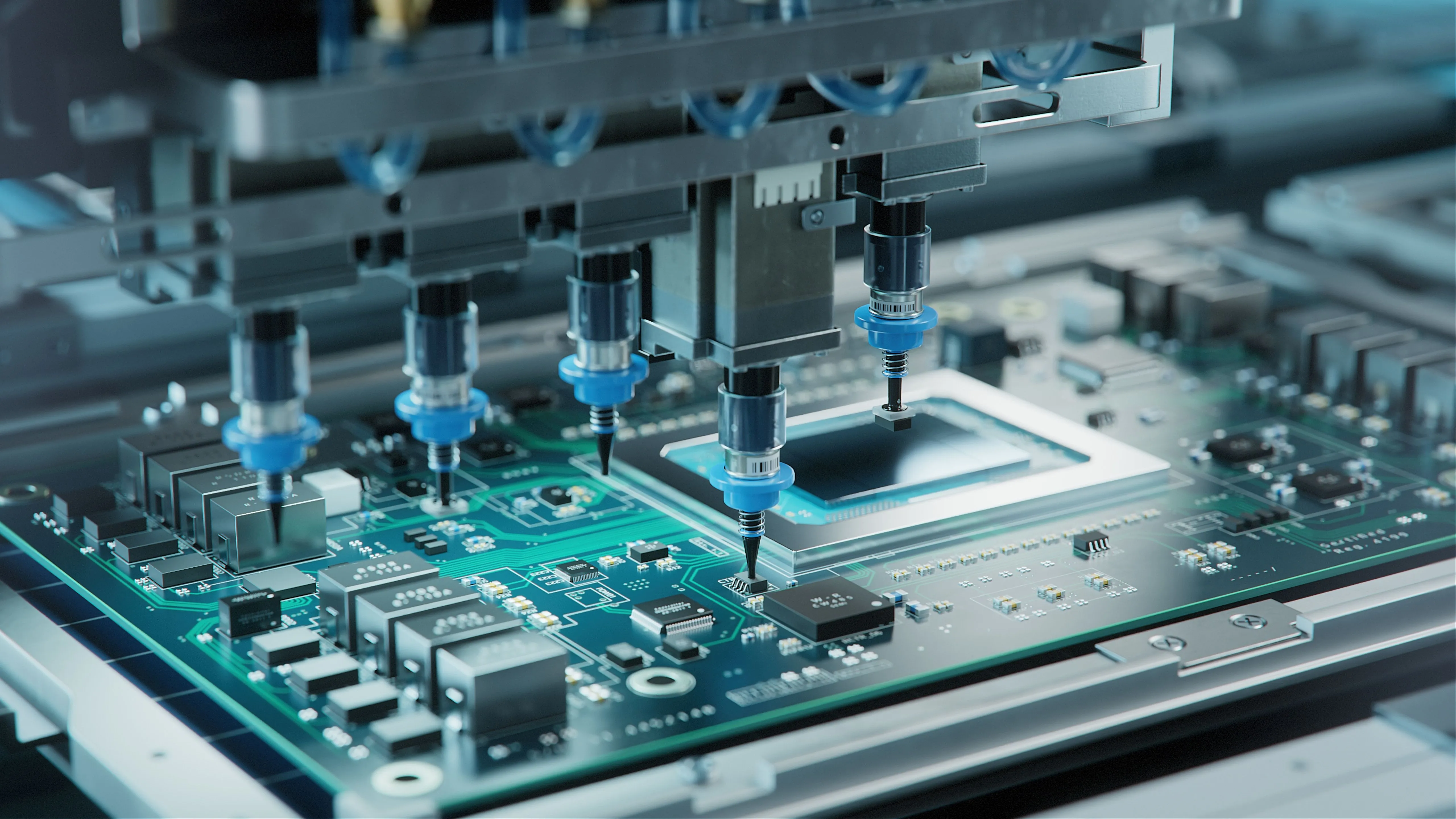

- Significant Competitive Advantage: As the only company providing specific technologies essential for semiconductor manufacturing, ASML maintains a unique position in the market.

- Innovation in Technology: Ongoing investments in R&D help ASML stay ahead in the AI stock game, making it a desirable asset for investors.

- Market Demand: The global demand for advanced chips continues to rise, further solidifying ASML's market presence.

Investing in AI Stocks: What ASML Means for the Future

With established protocols in place and a strong foothold in the semiconductor industry, ASML's strategic decisions provide reasons for optimism. The AI stock trend indicates promising opportunities for those willing to invest. Investors must weigh their options wisely and consider ASML's potential for continued growth.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.