ASML and TSMC: Dominance and Earnings in the Semiconductor Tech Sector

ASML and TSMC: Earnings Overview

In the rapidly evolving tech scenario, ASML and TSMC stand as titans of the semiconductor industry. Both companies have once again showcased their ability to command the market, resulting in unparalleled financial performance.

Financial Highlights

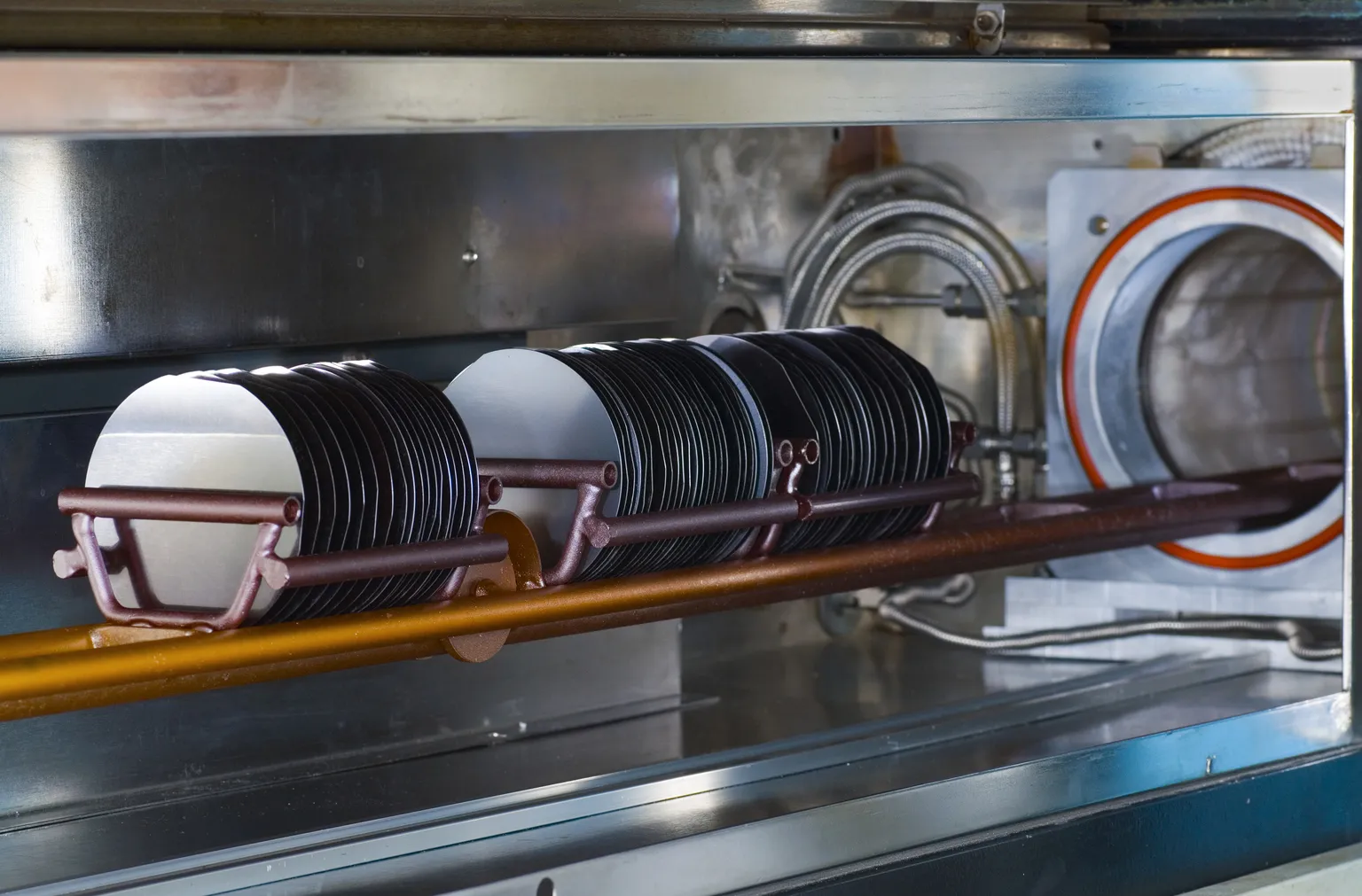

- ASML reported robust quarterly earnings, reinforcing its leadership in advanced lithography equipment.

- TSMC's revenues soared, driven by surging demand for chips across various sectors.

Market Position and Valuation

With forward P/E ratios maintaining around 30x, both ASML and TSMC present appealing investment opportunities. Their monopolistic positions solidify their valuation in the tech sector, making them prime candidates for any investment portfolio.

Investment Considerations

- ASML and TSMC are key players in the semiconductor supply chain.

- Investment in these companies anticipates future growth in tech.

- Market dynamics indicate strong demand for semiconductor products.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.