Artificial Intelligence Investment: Philippe Laffont's Bet on Taiwan Semiconductor

AI Investments Reshape the Semiconductor Landscape

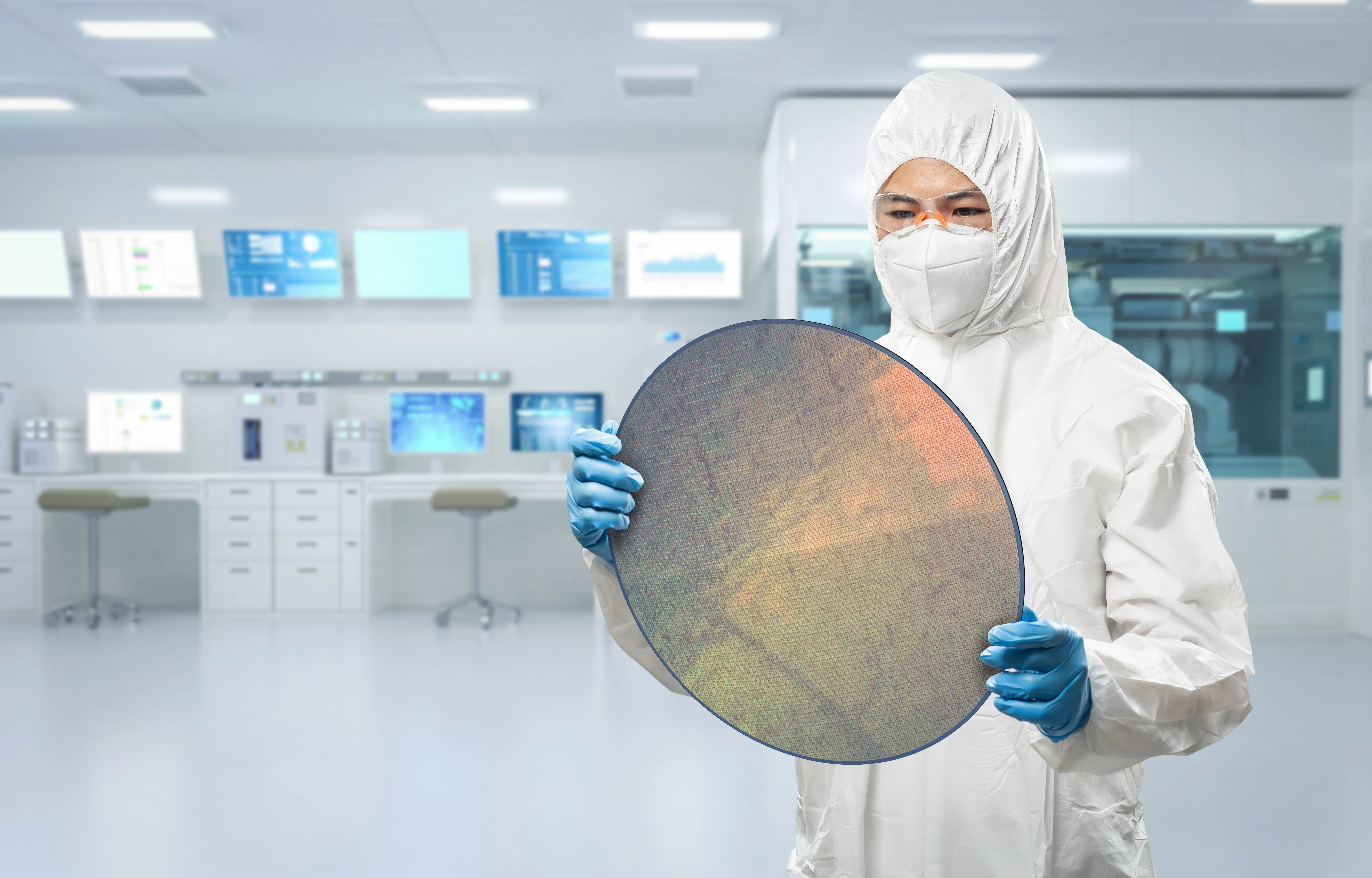

Artificial Intelligence is revolutionizing various sectors, and semiconductors play a crucial role in this transformation. Taiwan Semiconductor (TSMC) has been at the forefront of this evolution. Philippe Laffont's hedge fund, Coatue Management, has been acquiring shares of TSMC consistently, signaling strong confidence in the company's future.

Significance of TSMC in AI Development

Taiwan Semiconductor is not just another chip-making company; it is pivotal in producing advanced chips that power AI applications. As demand for AI continues to surge, TSMC stands out as a key player with unmatched manufacturing capabilities.

Reasons Behind the Investment

- Growing demand for AI-driven technologies

- Innovative chip designs enhancing performance

- Strong financial fundamentals boosting investor confidence

Industry Implications

The commitment from Philippe Laffont suggests that AI-focused semiconductor investments will likely drive market trends. As more companies pivot towards AI, TSMC's role in supplying the necessary hardware becomes increasingly vital.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.