Investing in Nvidia: Record Insider Stock Sales and Market Implications

Insider Selling Spree Raises Concerns

Nvidia (NASDAQ: NVDA) has seen its stock rally amid substantial insider selling in 2024. Over $1.8 billion and nearly 11 million shares have changed hands, marking the highest insider sales since 2020.

Key Players in Sales

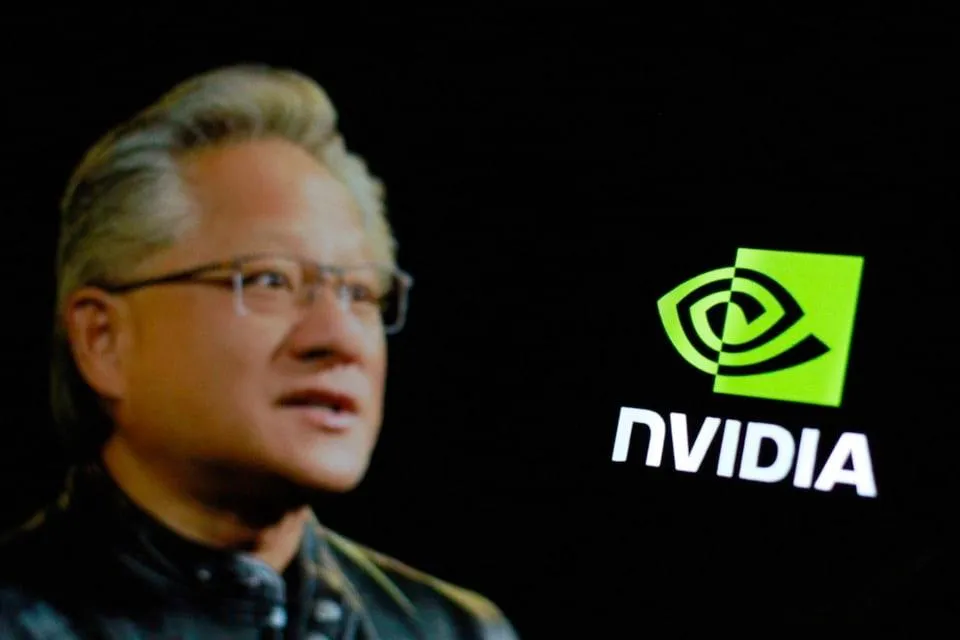

- CEO Jensen Huang: Planned sale of over $700 million in NVDA shares.

- Mark Stevens: Board member with a recent sale of $4.8 million.

- Tench Coxe: Nvidia's third-largest shareholder.

These sales trigger questions about the confidence held by insiders in the company’s performance, particularly as Nvidia's share price exhibits volatility.

Nvidia's Market Challenges

The ongoing sales coincide with possible antitrust investigations and delays in the highly anticipated Blackwell chips. Concerns about competition in the AI semiconductor sector loom large for investors.

Nvidia Stock Outlook

- Currently trading around $124, NVDA is trying to maintain momentum above support levels.

- Market analysts suggest the stock could hit $150 by December.

- Long-term projections may see NVDA touching $800 by 2030.

Nvidia's predominance in AI technology keeps investor interest high, but securing future demand is vital as insider trends can heavily impact market sentiments.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.