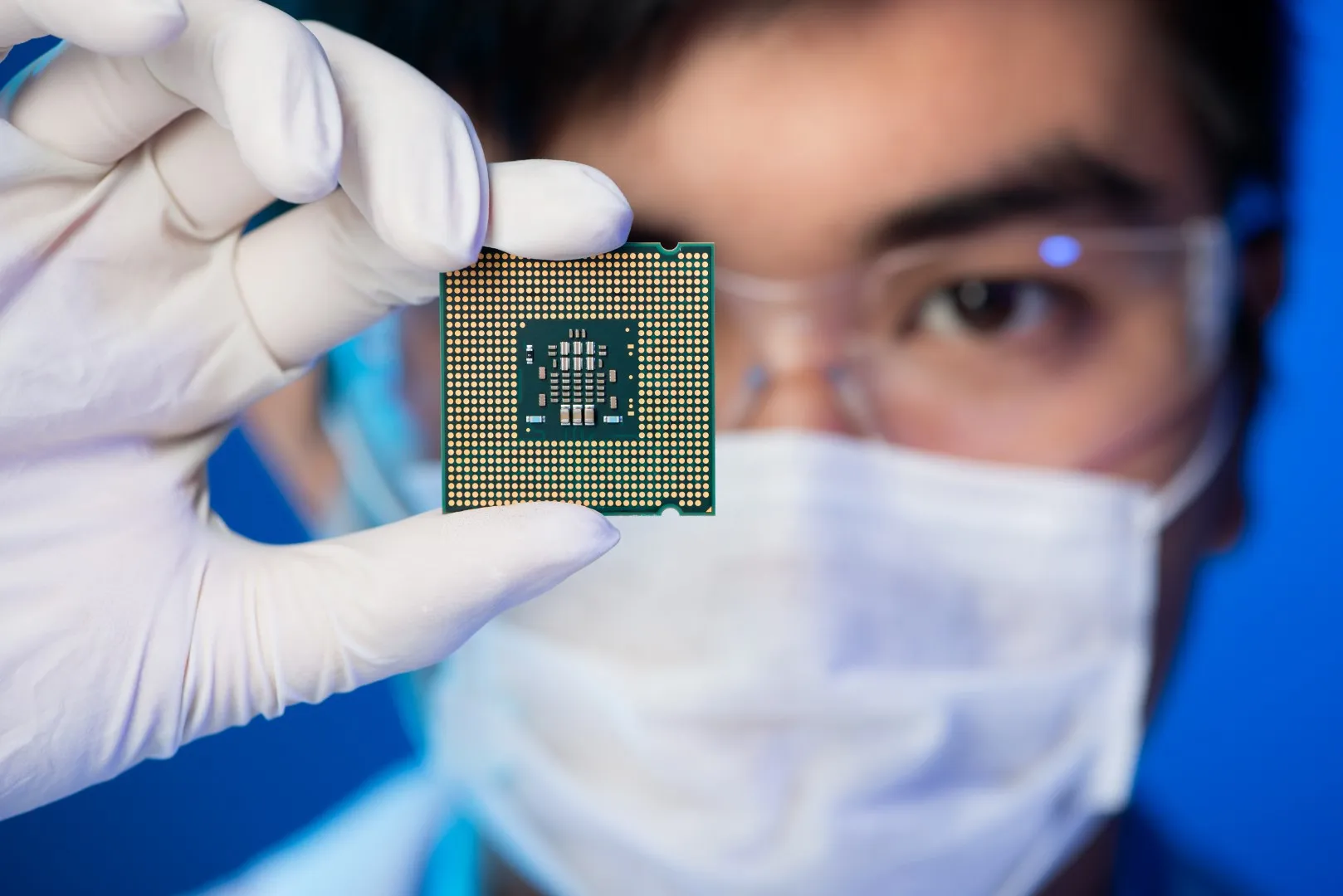

Why Intel Stock Remains a Smart Buy Despite Recent Declines

Understanding the Intel Stock Situation

Intel stock has seen a drastic decline recently, crashing to below $20 per share due to cost-cutting measures. This drastic shift raised eyebrows in the investment community, prompting discussions about the future of this tech giant.

Market Analysis of Intel Stock

Currently, Intel trades below its book value, an exceedingly pessimistic valuation that doesn’t accurately reflect its long-term potential. Investors might be taking advantage of this low price point, seeing it as a buying opportunity.

- Cost-Cutting Strategies: Intel's decision to cut costs is a strategic move aimed at long-term recovery.

- Valuation Concerns: The market's reaction has resulted in an undervaluation of the company's assets.

- Investor Sentiment: Many investors are cautiously optimistic about Intel's future.

Final Thoughts on Intel's Prospects

Considering Intel's essential role in the tech industry, the current stock price presents a significant opportunity for vigilant investors. Markets can swing, but strong fundamentals often prevail. Check back for updates on Intel stock performance!

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.