KKR's Ambitious Plans for ASMPT: A Potential Game Changer in Semiconductor Equipment

KKR's Strategic Interest in ASMPT

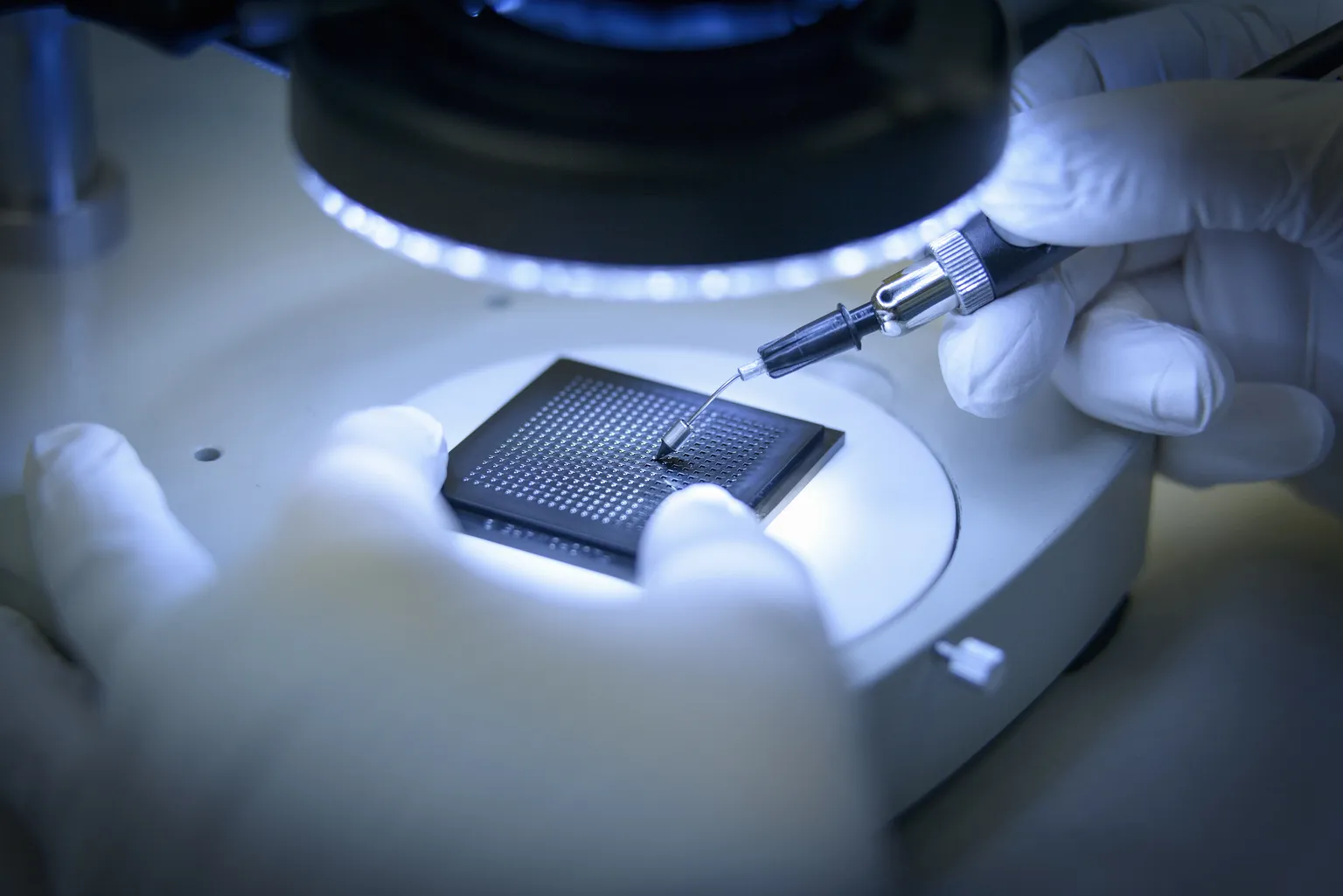

KKR (KKR), a prominent private equity firm, is reportedly in talks to make a significant bid for ASMPT, a leader in semiconductor equipment manufacturing. This potential acquisition could reshape the landscape of the semiconductor industry, emphasizing the increasing appetite for investment in technological innovations.

The Semiconductor Market Dynamics

The semiconductor sector has been experiencing rapid growth, driven by developments in technology and increased demand for chips in various applications. KKR's interest underscores a broader trend of private equity firms recognizing the value in semiconductor companies and their essential role in the global economy.

Key Considerations for KKR

- Strategic fit within KKR's portfolio

- The technological advancements of ASMPT

- Market reactions and potential risks

As this situation develops, analysts will closely monitor how KKR's potential takeover bid affects not only ASMPT but also the broader semiconductor equipment market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.