Hedge Funds Shift From Tech to Consumer Discretionary Amid Record China Stock Purchases

Market Shifts: Hedge Funds' New Direction

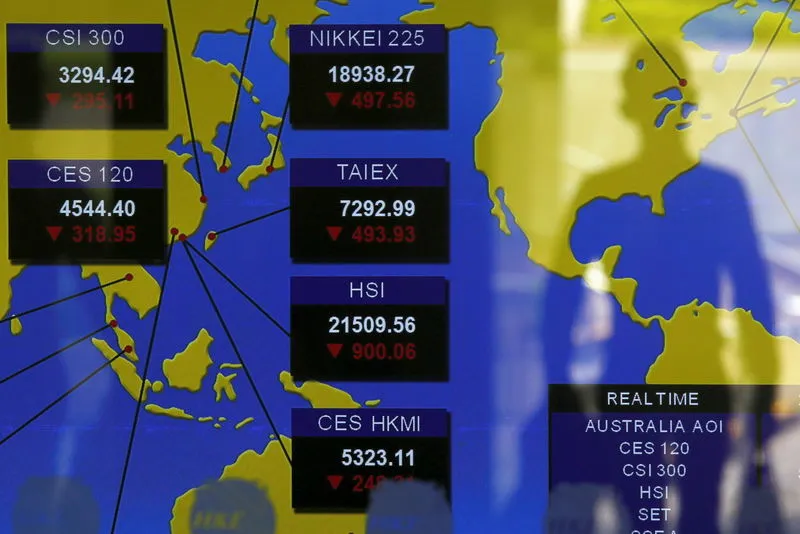

Hedge funds are moving out of the Information Technology, Energy, and Financials sectors, seeking fresh opportunities in Consumer Discretionary, Materials, and Consumer Staples. According to Goldman Sachs' report, this strategic adjustment indicates a pivotal shift in market focus, influenced by record levels of buying in China stocks.

The Impact of China Stock Purchases

- Record Buying: Hedge funds recorded the largest weekly net buying in China stocks, reshaping investment landscapes.

- Strategic Rotations: This trend reflects a broader strategy among investors to explore opportunities beyond traditional tech stocks.

- Market Response: The consumer-driven sectors show a promising resilience, attracting significant capital from hedge funds.

In a time when major players are reassessing their portfolios, keeping a keen eye on these shifts can provide insights into future technological and financial developments.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.