Arm's Inquiry into Intel Inside: What Does it Mean for the Chip Market?

Arm's Inquiry into Intel Inside

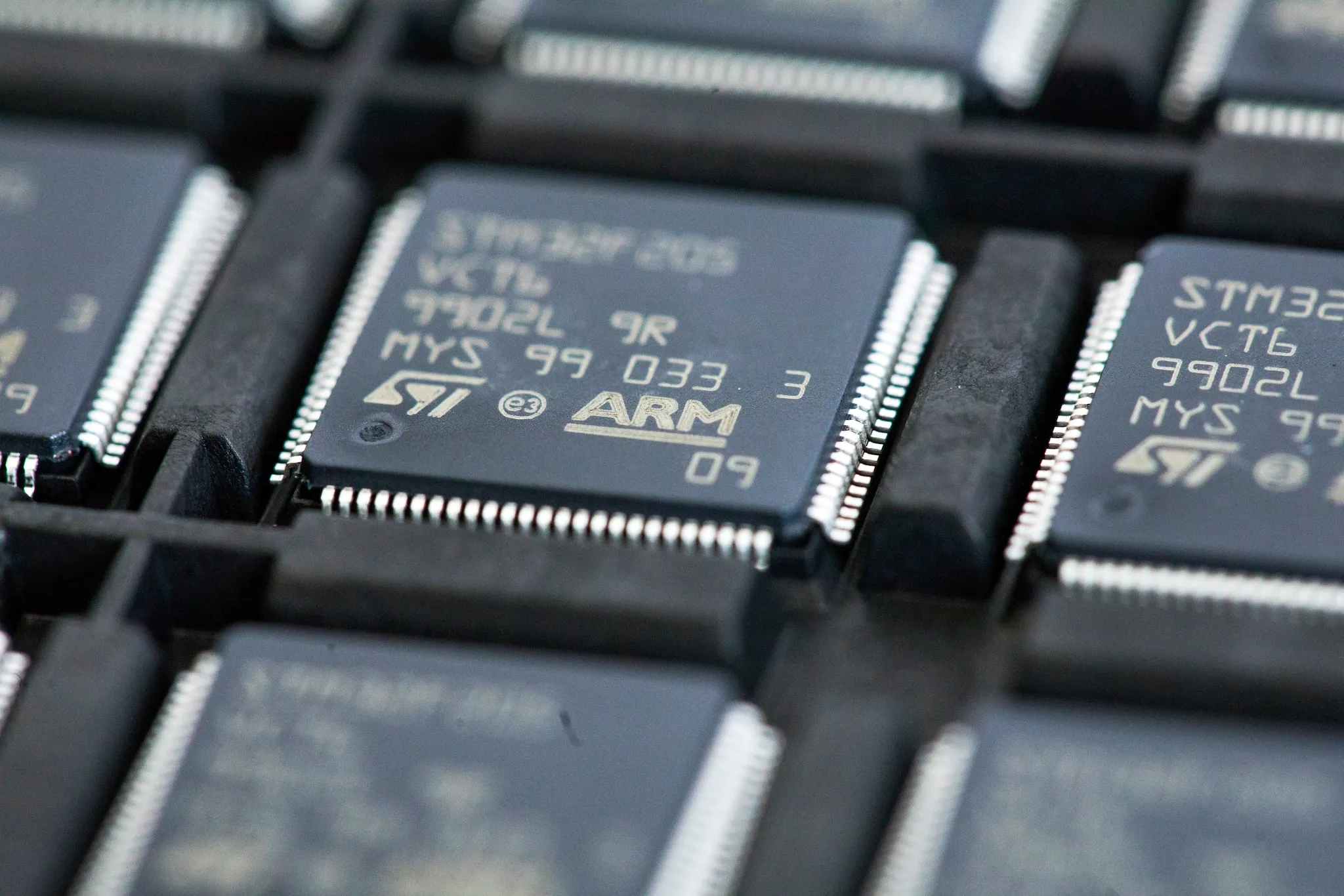

Arm Holdings Plc approached Intel Corp. about potentially buying the ailing chipmaker’s product division, only to be told that the business isn’t for sale, according to a person with direct knowledge of the matter. In the high-level inquiry, Arm didn’t express interest in Intel’s manufacturing operations, said the person, who asked not to be identified because the discussions were private.

Intel's Market Position

Intel, once the world’s largest chipmaker, has become the target of takeover speculation since a rapid deterioration of its business this year. The company delivered a disastrous earnings report last month—sending its shares on their worst rout in decades—and is slashing 15,000 jobs to save money. It’s also scaling back factory expansion plans and halting its long-cherished dividend.

Future Prospects for Arm

As part of its turnaround efforts, Intel is separating the chip product division from its manufacturing operations. The move is aimed at attracting outside customers and investors, but it also lays the groundwork for the company to be split up—something Intel has considered, Bloomberg reported last month. Arm, which is majority-owned by SoftBank Group Corp., makes much of its revenue selling chip designs for smartphones, but Chief Executive Officer Rene Haas has sought to broaden its reach outside of that industry.

- Combining with Intel could expand Arm's reach

- Arm moves towards selling fully formed products

- Intel considers other investment options

The Broader Context

Under Haas, Arm has been shifting towards offering fully formed products—potentially putting it in competition with its licensees. Arm, based in Cambridge, England, currently has a fraction of the revenue of Intel but its valuation has soared since an initial public offering last year and now stands at more than $156 billion.

In contrast, Intel has lost more than half its value this year with a current market capitalization of $102.3 billion. The future dynamics between these two tech giants promise to reshape the landscape of the chip industry.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.