How Covid 19 Is Transforming Africa’s Fintech Landscape

How Covid 19 Is Transforming Africa’s Fintech Landscape

Covid 19 has significantly impacted the financial technology (fintech) industry in Africa, acting as a catalyst for rapid growth and innovation. The pandemic has forced both consumers and businesses to adapt to new digital financial solutions, enhancing operational efficiency and accessibility.

Driving Forces Behind Fintech Growth in Africa

The demand for digital financial services has skyrocketed as traditional banking faced challenges. Here are some key drivers:

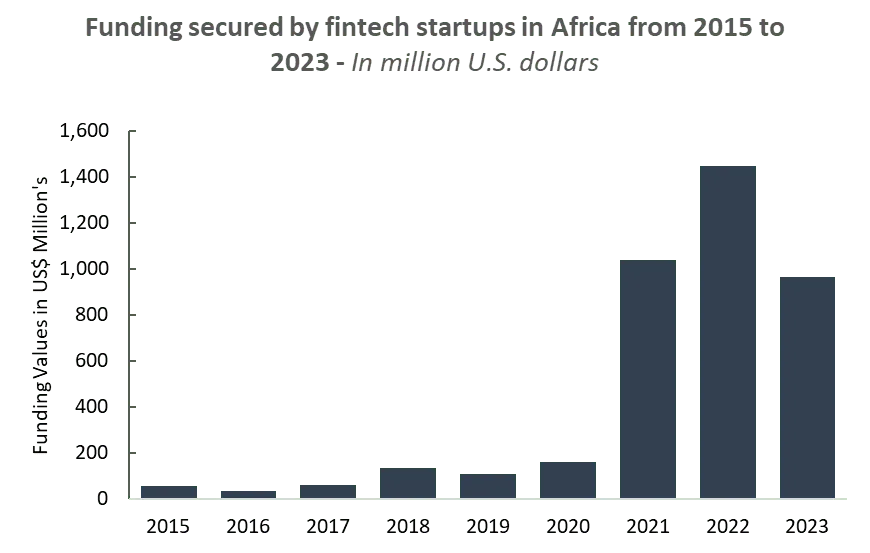

- Increased Investment: Investors are pouring resources into fintech, eager to support scalable solutions.

- Shifts in Consumer Behavior: Remote transactions have become the norm, necessitating innovative payment solutions.

- Regulatory Support: Governments are creating conducive environments for fintech startups to thrive.

Impact on Financial Accessibility

Covid 19 has highlighted the necessity of accessible financial services, particularly in underserved areas. Fintech has stepped in to bridge these gaps:

- Mobile banking platforms are facilitating transactions without the need for physical bank visits.

- Digital lending services are providing loans with less stringent requirements.

- Insurance tech is offering tailor-made products to a wider audience.

Conclusion: A New Era for Fintech in Africa

As the landscape evolves post-pandemic, the resilience shown by fintech companies in Africa heralds a promising future. With ongoing innovations and consumer-centric solutions, the industry is set for monumental advancements.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.