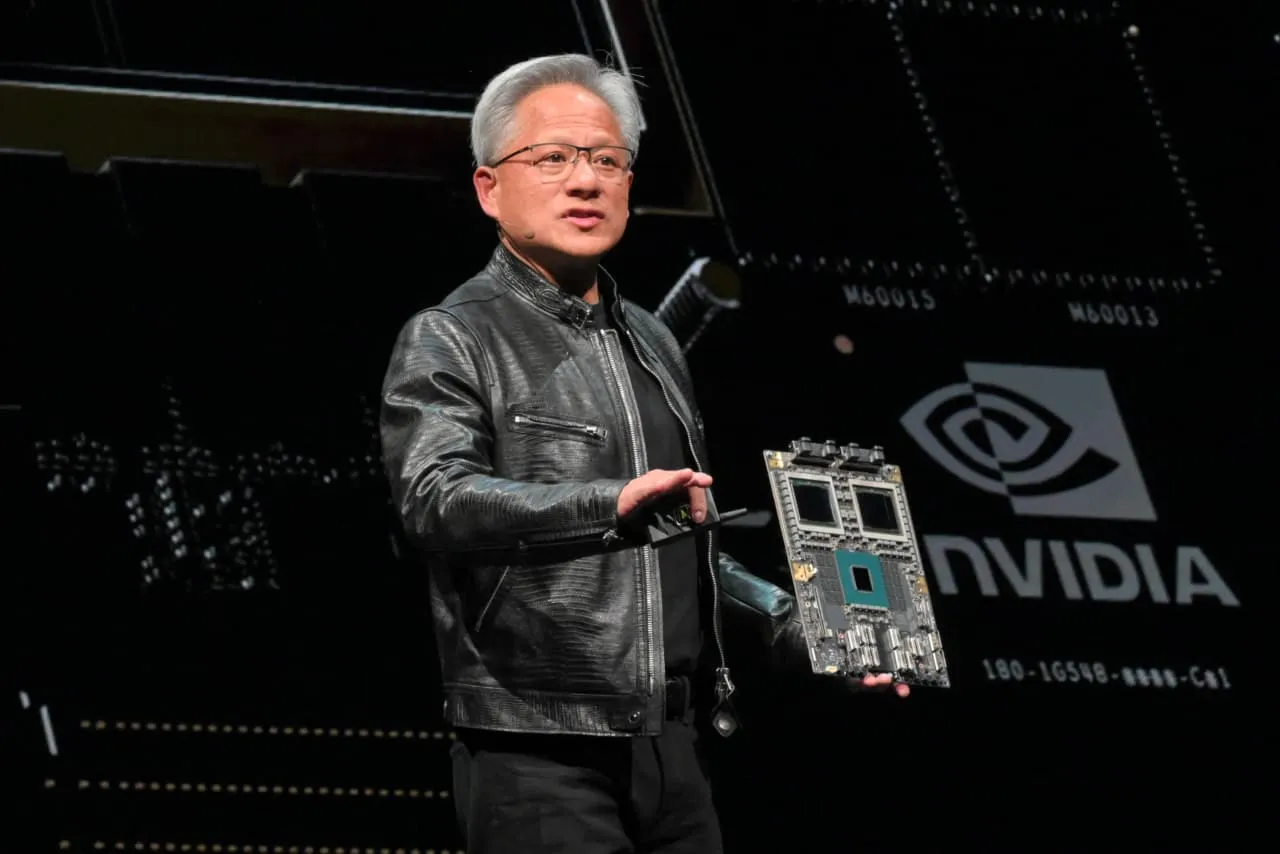

Understanding Nvidia's Corporate Actions: Jensen Huang's $713 Million Stock Sale

Nvidia, a leader in semiconductors and graphics processing units, is making headlines as CEO Jensen Huang completes a staggering $713 million stock sale. This sale comprised of six million shares, influenced by his trading plan, which concluded six months ahead of its designated expiration period.

Insight into Recent Corporate Actions

This significant sale has raised eyebrows and led to speculations regarding ownership changes within the company. Industry experts point towards a potential shift in corporate strategy as Huang navigates through dynamic technology and manufacturing environments.

Implications for Nvidia and Beyond

- This stock sale might indicate Huang's insights on the *future* of Nvidia's stocks.

- Further discussions around *acquisitions* and *mergers* in the semiconductor industry may come to the forefront.

- Shareholders and investors are advised to keep a keen eye on *corporate actions* stemming from this sale.

Understanding these financial maneuvers can provide invaluable insights into the technology sector's direction moving forward, especially concerning major players like Nvidia.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.