CPUs and Processors in the Technology Industry: Qualcomm's Acquisition Efforts Stumble

Tech Industry Dynamics

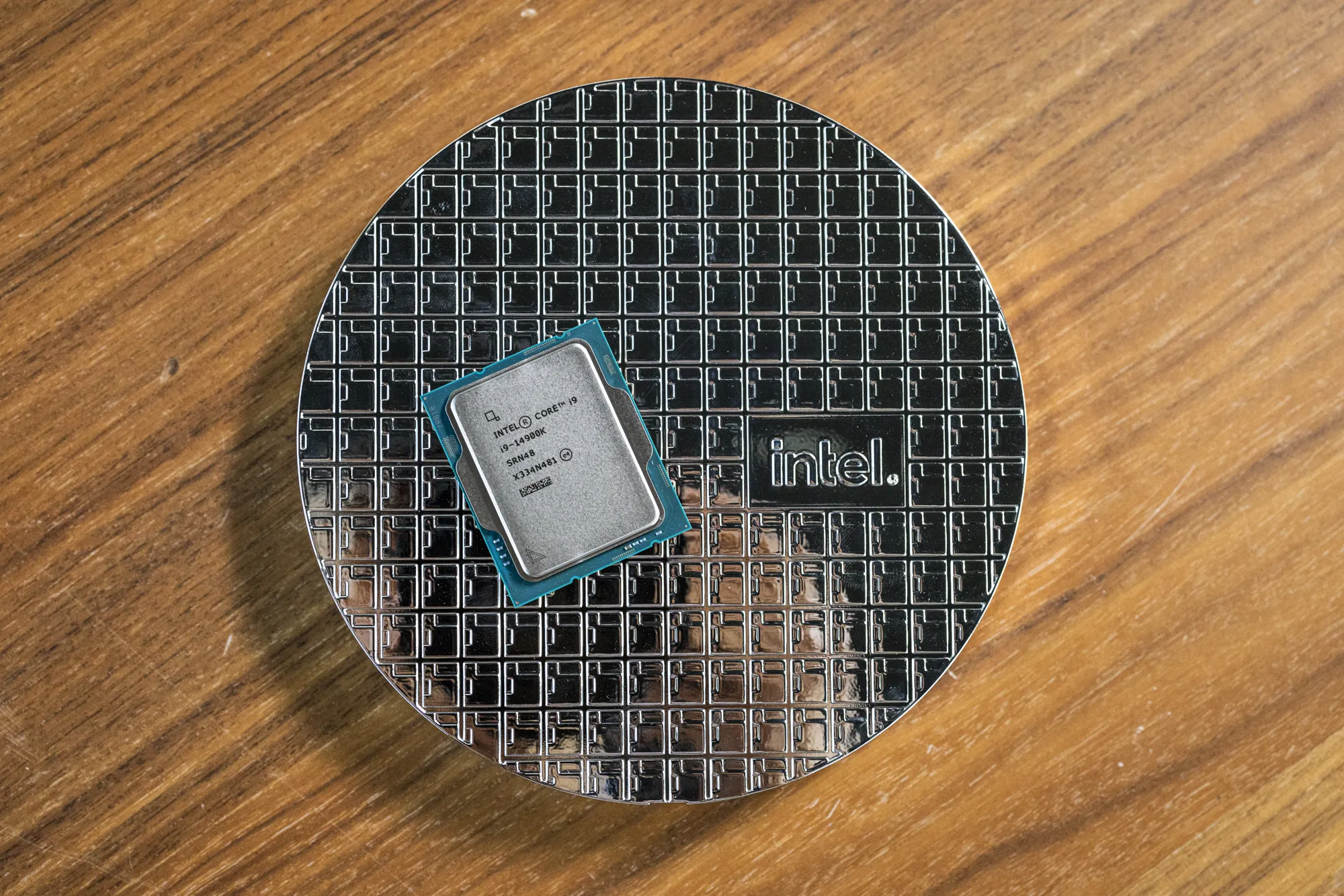

The hits just keep on coming for Intel. AMD's Epyc chips are gobbling up market share in data centers while Intel's desktop chips are frying themselves after years of being stuck on a stalled architecture. The company is laying off 15,000 people and spinning off its foundry business. And now that Intel is on the ropes, the Wall Street Journal reports that Qualcomm approached the company about a takeover, licking its lips over the possibility of swallowing Chipzilla whole.

Market Analysis

I'll eat my hat if it happens. Not just because Qualcomm buying Intel doesn't make sense given the companies' stock prices, cash reserves, and competitive positioning, as analyst Ming-Chi Kuo spells out. Not just because governments would likely shut the prospect down, with processors and foundries becoming a key battleground in international politics.

Challenges Ahead

- Intel's Valuation: The current valuation is less than the sum of its parts.

- Ownership Risks: The industry almost let AMD die a decade ago due to ownership changes affecting the vital x86 cross-licensing pact.

- Reputation at Stake: Qualcomm or any potential buyer would need to navigate a treacherous negotiation landscape.

A Look Back

These days, AMD is riding high on the AI wave and buying up companies left and right. But the story was very different a decade ago.

Past Struggles

- Struggling after ATI's Radeon graphics acquisition.

- Devastating results from the Bulldozer CPU launch.

- Debt burden leading to the spinoff of its fabrication arm.

For years afterward, AMD's very survival was a question mark until AMD's new Zen architecture turned the tide. The landscape has shifted dramatically, making the idea of such a merger even less feasible.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.