Unity Stock's Bullish Support: What the Downgrade To Hold (NYSE:U) Means for Investors

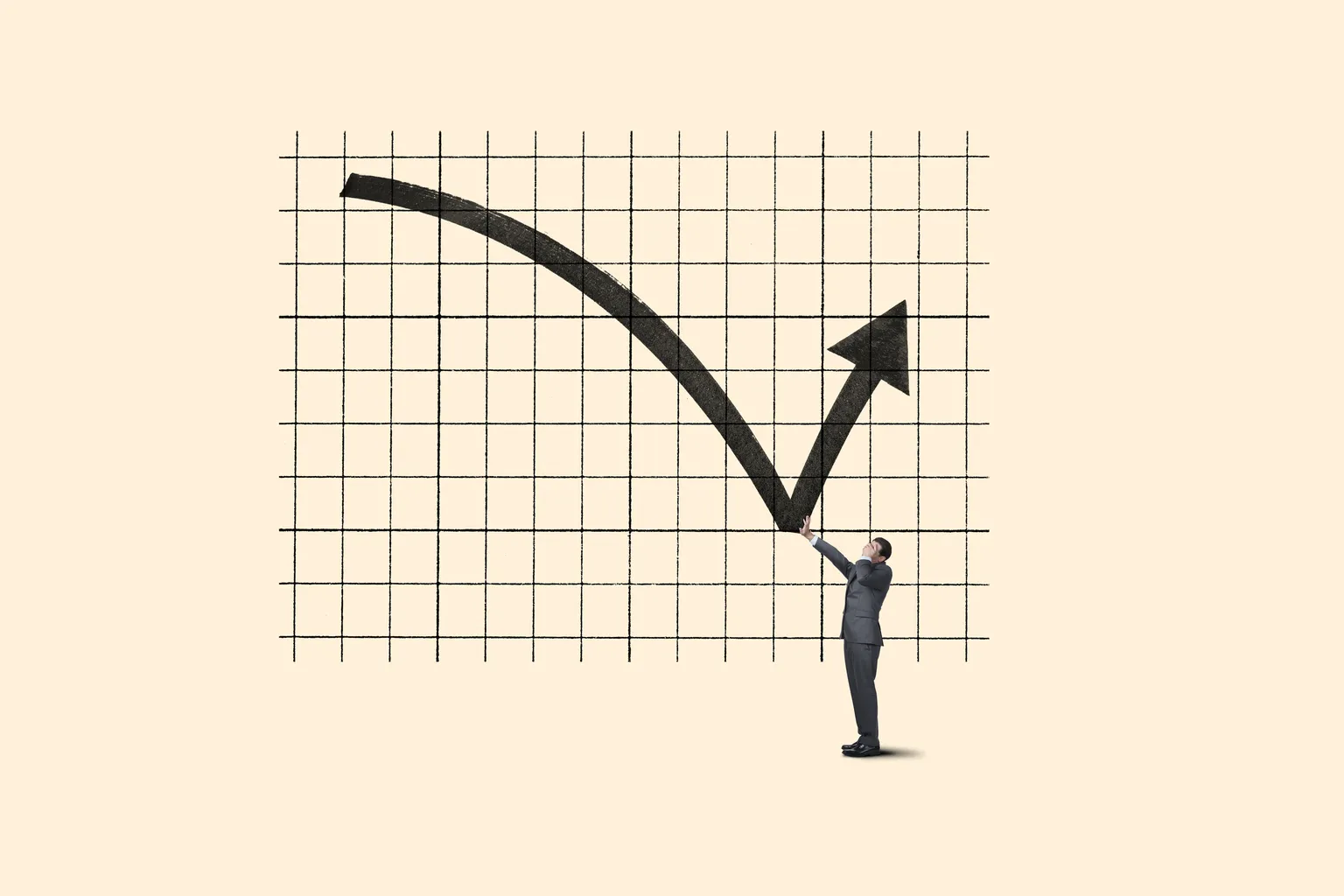

Unity Stock's Bullish Support Explained

Unity stock's bullish support could provide a turning point for investors following the Downgrade To Hold (NYSE:U). The company recently announced the termination of controversial runtime fees, which had been a sticking point for many users. Instead, Unity plans to revert to traditional Software as a Service subscription price hikes, set to take effect in 2025. This decision is an attempt to align with investor expectations and improve overall market perception.

What This Means for Future Growth

As Unity moves to a more predictable revenue model, the focus will be on how this affects long-term investor confidence. The potential for steady income could position Unity as a more stable option in an unpredictable tech market.

- Termination of runtime fees

- Return to conventional SaaS pricing

- Shift in investor sentiment

Key Factors to Monitor

- Market reactions to the downgrade

- Future earnings reports

- Investor trust in Unity's long-term strategy

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.