AI Perspectives on the Justification of the Federal Reserve's 50 Basis Points Rate Cut

Monetary Policy Shifts: A Necessary Step?

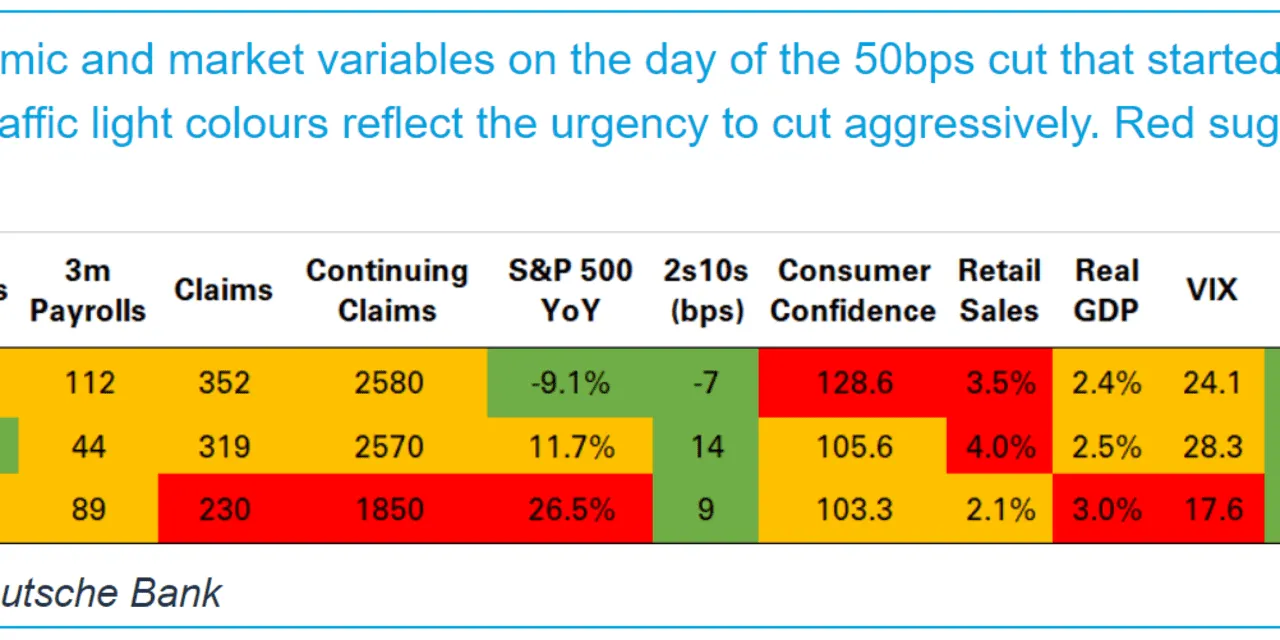

The Federal Reserve's recent decision to cut interest rates by 50 basis points has raised eyebrows across the financial landscape. Analysts argue this action, marking the commencement of a new monetary policy easing cycle, appears more controversial compared to cuts executed in 2001 and 2007.

AI and Deutsche Bank's Standpoint

- According to Deutsche Bank’s Jim Reid, the current economic environment may not warrant such drastic measures.

- Historical context from previous rate cuts shows varying outcomes that complicate current evaluations.

- AI tools are increasingly utilized to analyze and predict the impact of monetary policy on the economy.

Broader Implications for Economists

- The implications of this rate cut are significant for financial markets and future economic growth.

- As AIs forecast potential trajectories, economists must reconsider past frameworks for response.

With substantial economic consequences on the horizon, the urgency for deeper analysis and discussions surrounding interest-rate changes is critical.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.