Exploring Micron's Stock "Death Cross" Pattern: Implications and Insights

Understanding the "Death Cross" Pattern

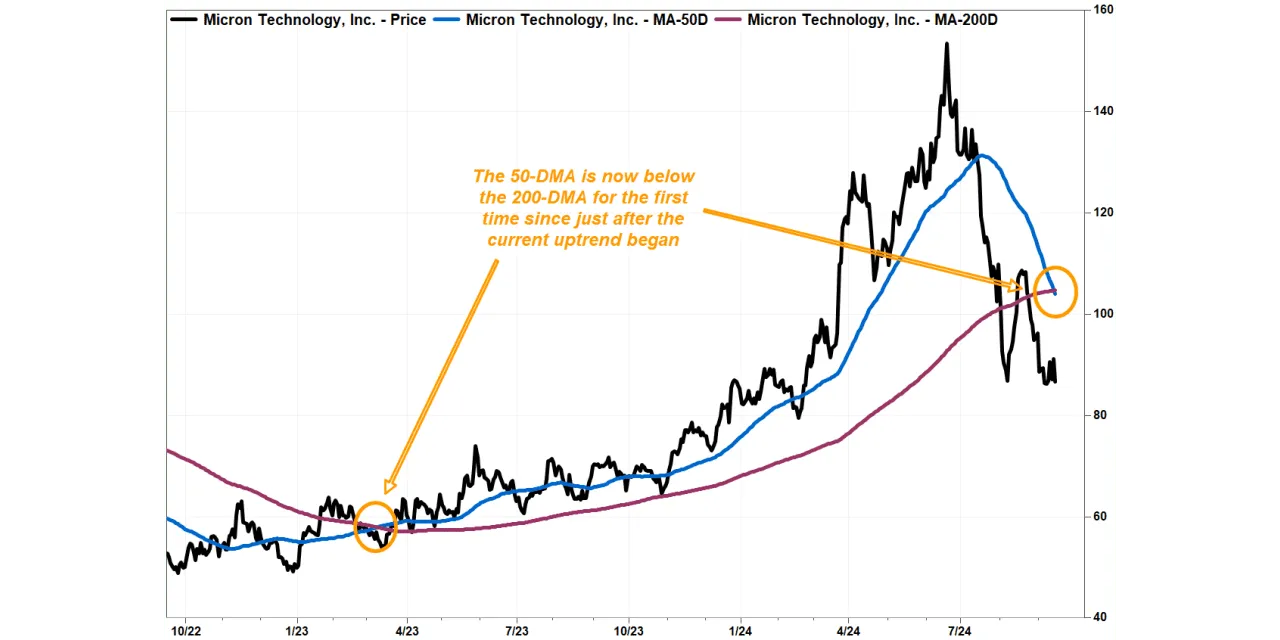

The "death cross" is a significant technical indicator where the 50-day moving average drops below the 200-day moving average. This pattern often raises alarm bells for investors, suggesting a potential downtrend. In Micron's case, this occurrence is notable since it is the first in two years.

Implications for Investors

As Micron has shown, the appearance of the "death cross" could mean escalating losses and heightened market volatility. Investors should approach with care and consider various market conditions.

- Monitor stock performances closely.

- Evaluate broader market trends.

- Consider expert analyses for informed decision-making.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.