PalmPay USSD: Your Gateway to Quick Mobile Money in Nigeria

Introduction to PalmPay USSD Service

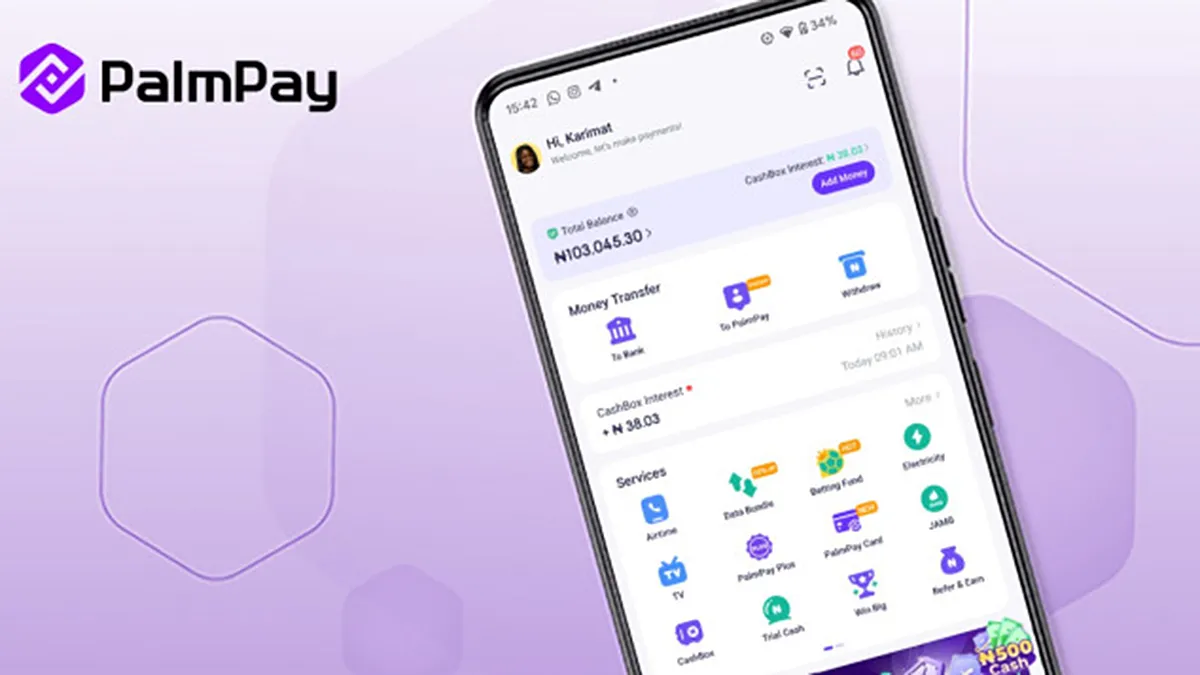

PalmPay, a fintech platform, has introduced an Unstructured Supplementary Service Data (USSD) code for its Nigerian consumers. In a statement, the fintech stated that the USSD platform includes a variety of mobile-money features aimed at providing seamless financial transactions.

Key Features of PalmPay USSD

- Easy Access: Users can effortlessly perform transactions without needing internet connectivity.

- Central Bank Compliance: The service aligns with regulations set by the Central Bank of Nigeria, ensuring secure operations.

- User-Friendly: Designed to guide consumers through transactions with simplicity.

Benefits for Nigerian Consumers

The introduction of PalmPay USSD aims to enhance financial inclusion among users who may not have access to traditional banking. With mobile-money solutions, transactions become simpler, aiding commerce across various sectors.

Conclusion

In summary, PalmPay's USSD service signifies a step forward in Nigeria's mobile-money landscape. It promises to deliver innovative financial services that engage a broad consumer base throughout the country.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.