Nvidia Executive Stock Sales Termination Highlights Market Dynamics

Nvidia Executive Stock Sales Overview

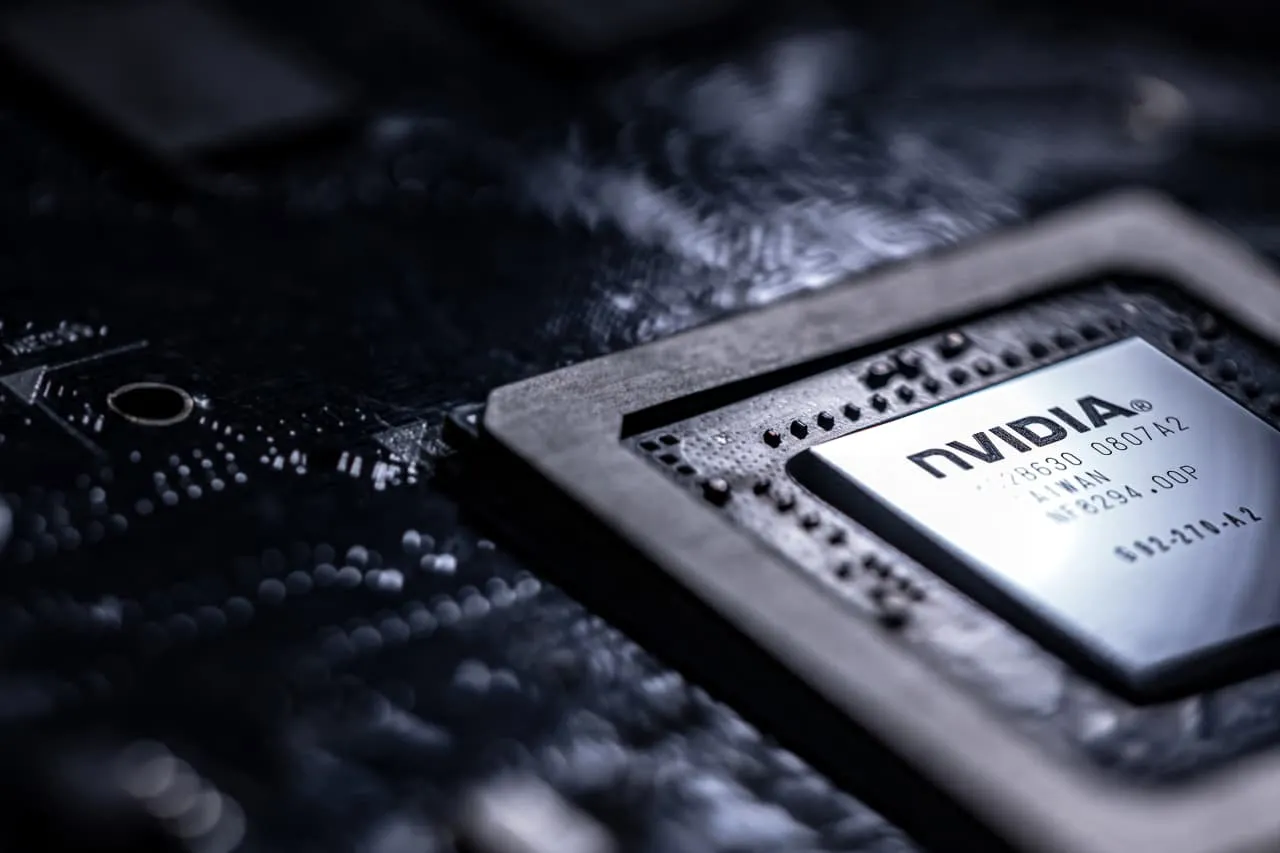

Ajay K. Puri, Nvidia's executive vice president, made headlines by terminating his stock-selling plan prematurely as the company’s share price faced declines. This decision could indicate shifts in the technology landscape, notably in computing and graphics processing units.

Market Implications

The halt in stock sales prompts a closer examination of Nvidia’s financial performance and future strategies in a competitive semiconductors market. Investors may want to consider how corporate actions like this influence longer-term predictions.

Key Takeaways

- Ownership Changes: Understanding insider decisions helps gauge company confidence.

- Acquisitions and Mergers: These actions impact share prices and market positioning.

- Effective management remains a pillar for Nvidia's continued success.

Conclusion Efforts

As insider stock sales become pivotal in corporate news, further scrutiny reveals the strategic adjustments necessary in the consumer electronics sector.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.