California Proposition 35: An Overview of Healthcare Insurance Regulation

California Proposition 35 Explained

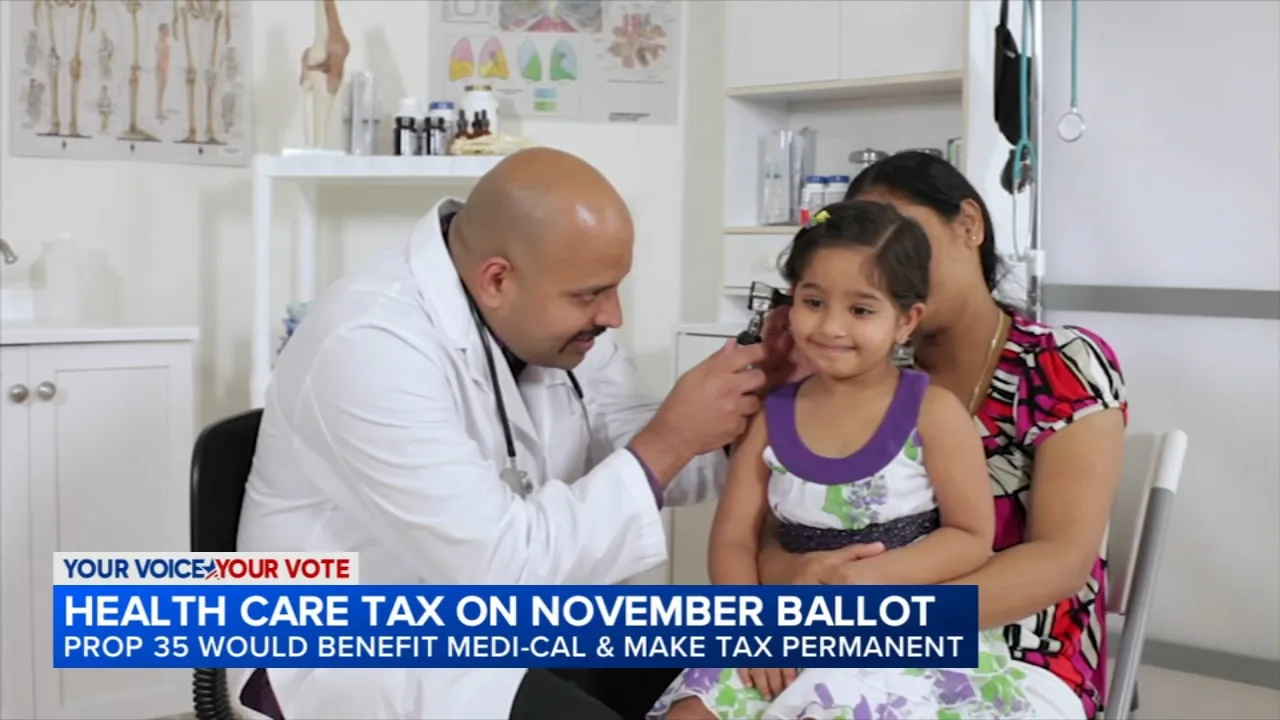

California Proposition 35 addresses crucial aspects of healthcare regulation in the state. This measure allows the state government to implement a tax on specific managed healthcare insurance plans. Providers such as Kaiser Permanente may be subject to this tax, which aims to enhance funding for state healthcare resources.

Targeted Healthcare Insurance Plans

- Managed care organizations

- Publicly funded insurance

- Providers impacted by Proposition 35

Potential Impacts on Tax Revenue

- Increased funding for healthcare services

- Potential rise in insurance premiums

- Long-term benefits for community health initiatives

The implementation of Proposition 35 could lead to significant shifts in the healthcare landscape of California. As various insurance plans adapt, stakeholders will need to monitor these changes closely.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.