Understanding the Exclusion of Medical Bills from Credit Reports

Proposal Overview

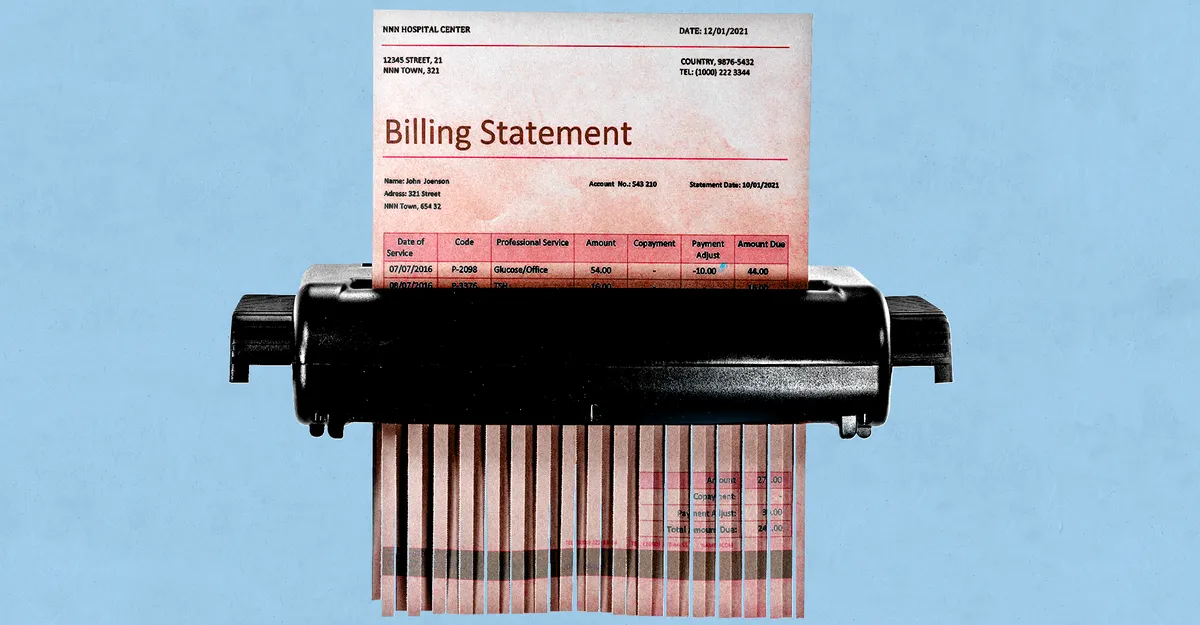

The Consumer Financial Protection Bureau (CFPB) has proposed a revolutionary change regarding medical bills and their reporting on credit history. Aiming to support individuals burdened by healthcare expenses, this proposal suggests that medical debt should not affect credit scores.

Implications of this Change

- Financial Relief: Patients grappling with medical bills may find their financial situations improving.

- Accessible Healthcare: Reducing the stigma of medical debt encourages people to seek necessary care.

- Long-Term Effects: Future implications on credit reporting could create a healthier economic environment.

Next Steps

- Monitoring the CFPB's rule-making process.

- Analyzing feedback from stakeholders.

- Understanding the potential timeline for implementation.

This potential shift in policy holds great promise for patients burdened by medical bills. Stay informed as we observe how this situation unfolds.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.